YC Alum Mendel, “Ramp for Latam Enterprises” collects $ 35 million Serie B

Mexico City -based Mendel He raised $ 35 million in a range of Serie B funding, he says exclusively to TechCrunch.

Corporate Cost Management Platform Mendel Last raised In December 2021 – a round of Serie A and $ 20 million – after participating in the Y Combinator Winter Cohorta 2021. With this latest capital infusion, the starter brought a total of $ 60 million in funding and $ 50 million through a credit facility.

Mendel’s mission is clear: to rediscover corporate cost management by automating most corporate financial Operations, which is currently being done manually. Or to put it simply, he wants to be one counter for all B2B costs. His offer integrates costs, payments and corporate trips.

“Our goal is to give financial directors and financial teams in Latin America in real time and control over their costs for employees, payments to suppliers or reservations for business travel,” said co-executive director and co-founder Alan Karpovski.

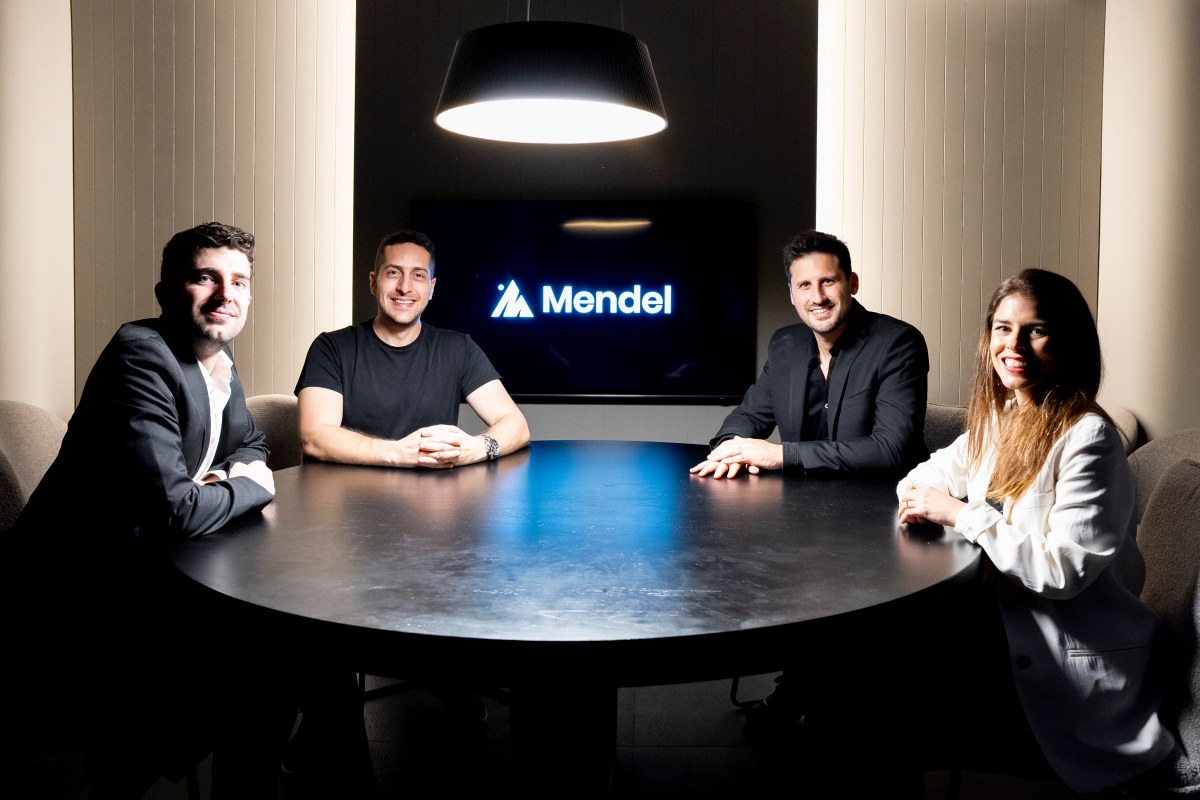

Karpovski and Alejandro Zekler (who previously founded and sold other start-ups) began Mendel in early 2021, and Helena Polyblank (CPO) and Gonzalo Castillion (CTO) later joined as co-founders.

Mendel declined to reveal the assessment, with Karpovski saying that only the circle reflects a “significant step up” from the company’s previous promotion. The company also declined to disclose firm revenue data, with Karpovsky noted only that its annual repetitive revenue (ARR) has increased almost 2.5 times compared to the year, with gross margins over 75%.

“We are not yet profitable, but we plan to reach profitability by the end of 2025,” he told TechCrunch.

Base10 Partners led the last round of Mendel, which included the participation of new investors Paypal Ventures and Endeavor Catalyst, as well as existing supporters Infinity Ventures, industrial endeavors and Hi.VC.

SAP agrees with Amex

The company says that since it is “first software” and focuses on businesses, it is able to charge repetitive fees for SAAS rather than rely exclusively on exchanges or loan -based models. Its revenue comes from a combination of SAAS fees (over 50%) for its cost management tool and tourist instruments and taxes for credit card exchange, as well as for taking a rate of your bill for payment of bills.

Karpovski believes that Latam’s focus of the company gives him an advantage over other global players, as he is able to cope with “complex, country -specific provisions”, such as tax codes, billing requirements and many currency work processes, among other things.

“We like to say that” Mendel is like Sap Conscur and Amex to have a child, “Karpovski replied.

As for comparisons with New York -based Decacorn RampHe said in many ways, “Mendel is like a ramp for Latin American enterprises with several differentials, including the fact that he is focused on” large, complex organizations that require multi -ethical, very currency, multi -order and deep ERP integration. “

Currently, Mendel has 80 employees, compared to 64 employees a year ago. Looking forward, the company plans to expand geographically. He is already working in Mexico and Argentina with about 500 clients, including Mercado Libre, Femsa, Adecco and McDonald’s. He is looking to expand in Chile, Colombia and Peru in 2025 and Brazil in 2026.

“Our approach from Day Zero was first the consolidation of the largest Spanish-speaking market in Latam before the geo-expansion begins,” Karpovski said.

BASE10 partner Jason Kong told TechCrunch that his company is attracted to what is being seen as Mendel’s “unique positioning” as a platform for the cost management of large companies in the undervalued – but growing Latin America.

“The high capital efficiency of the company is positive in December 2024-is highlighted in a sector where many players are struggling with the single economy,” Kong added. “In addition, Mendel’s ability to replace inherited solutions such as SAP are coordinated and earned large customers of businesses with fast sales speed (under-3 months for 3,000+ employees enterprises) demonstrates a clear adaptation of the product market.” Other companies that also work in this space in Latin America include Clara and Jeeves – Another YC alum – but both are targeted at more SMB and rely more on transaction fees, Kong noted.