WPP plans US expansion having ‘looked at’ New York listing

Open Editor’s Digest for free

FT editor Rula Khalaf picks her favorite stories in this weekly newsletter.

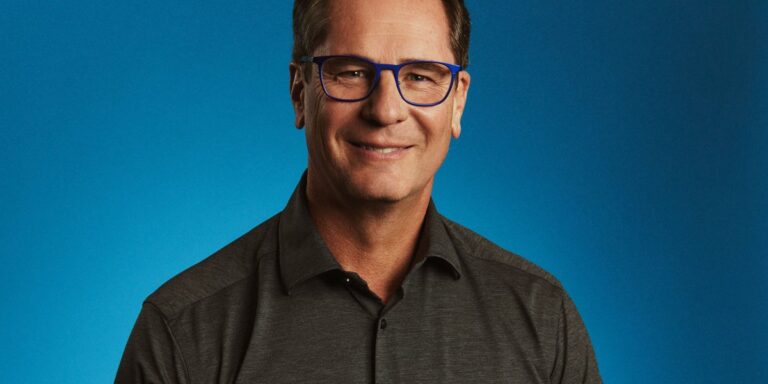

WPP has “looked” at moving its primary listing to New York, according to chief executive Mark Reed, who will pursue opportunities to take advantage of the “renaissance” in the US as Donald Trump re-enters the White House.

Reid told the Financial Times that this was the year the London-listed ad network began its push for AI, revenue growth and, despite his concerns about the health of the UK stock market, share price.

“We need to drive top-line growth to drive the share price. I’m very focused on that,” Reid said in an interview at his London Southbank office as he outlined plans for up to $100 million in additional AI investments to boost both creativity and productivity at his agencies.

“As a management team, we have a plan. We know what we have to do. And 2025 is the year of the death penalty, particularly the death penalty in AI.”

Reed said WPP had looked into moving its primary list to the US, adding: “That’s something we’re looking at.” While he’s not going to do that at this point, he noted that “other CEOs who’ve moved their rosters to the U.S. have had a positive experience.”

The market is closely watching Read’s next moves, with talk among corporate advisers and industry rivals of increased pressure on the chief executive following the arrival of the former BT boss. Philip Jansen as president three weeks ago.

WPP shares have fallen by a tenth over the past month and are now about a third lower than when Read took over in 2018. Shares in its French rival Publicis have almost doubled over the same period.

Meanwhile, WPP’s two biggest US rivals, Omnicom and IPG, were revealed last month merger programs to create a unified, New York-based advertising heavyweight.

Reid said that while a major deal for Omnicom-IPG is “obviously something we consider,” he would not pursue such a tie-up.

He also saw the merger as an opportunity, suggesting that WPP’s own period of restructuring pointed to disruptions ahead for its U.S. rivals. the challenges of consolidating companies involving agencies.

“There will be three major players in our industry. None of us are different in terms of size and scale,” he said. are two words that always go together.”

Redd has been criticized by some staff over a policy announced last week to bring people back to the office four days week But he said: “Ogilvy in New York is one of our top performing agencies. It’s busy and buzzing. You can feel the energy. And I’m sure those things are connected.”

Reid said the US, where it has about 38 percent of its business, would be a key growth area for WPP, including M&A programs focused on data and technology services to give it a greater presence in the world’s largest advertising market.

“With the Trump presidency, there is a resurgence of business confidence in the U.S.,” he noted, noting “a sense of ambition and growth in the U.S.” that also translated to how well their companies are doing in the stock market.

The UK government must “get to the bottom” of how to ensure the flow of capital that the FTSE 100 required, he said, noting how the valuation discount for London-listed companies was now “the biggest in history”.

“It is driving M&A and reducing the number of listed companies,” he added.

This was a challenge, he said, for the whole of Great Britain. WPP as a company to the US and the UK as a country to the US.”

WPP counts some of the biggest US tech companies as clients, including winning Amazon’s media business outside the Americas last year, but has been hit by a slowdown in advertising spending in the sector the world.”

He also noted how Trump brought a cultural change in corporate America in a short period of time. “The clearest example of the changes that have taken place in the Meta in the last six weeks. They see how the wind is blowing.”

Advertisers were also returning to X, a social media site owned by Trump ally Elon Musk. “Changing Content Moderation [at] The meta being more closely aligned with X probably helps that as well,” he said.

Looking ahead, he said he hoped earnings would improve this year, with plans to spend between £50m and £100m more than in 2024 on an AI platform that is being rolled out across the group’s 100,000 employees.

“We have a lot of new business opportunities,” Reed said.