Why lowering the yield on 10-year bonds is more important to Trump than the stock market or interest rates

- Trump administration has talked a lot About the yield of the 10-year treasury, the criterion of mortgage loans and other types of loans, as the President promises to reduce the cost of borrowing for Americans. Data suggest that more households are subject to interest rates than swings in the stock market, but the impact of inflation rate can ultimately be the most influential economic problem for voters.

Donald Trump loved splurge about the stock market at the beginning of his first lightning at the beginning. But as stock prices fall Making her again, again tariff threats and installation The fears of the recessionThe President noted that he no longer uses S & P 500, which is closed Corrective area: On Thursday, the figure fell from 10% in mid-February as a second term.

Instead, the new administration, including Treasury Secretary Scott Best, has been much more vocals bond market and Trump’s promise – lower borrowing costs for Americans. Beynents said that the focus of the president’s 10-year treasury mark, the balance of interest rates for the country, is about 12.6 trillion Mortgage marketMany corporate bonds and government’s own interest.

“We are focused on the real economy. We can create an environment where there are long-term profits in the market and long-term profits for the American people. ” Batet told CNBC: Thursday. “I am not worried about three weeks with a little instability.”

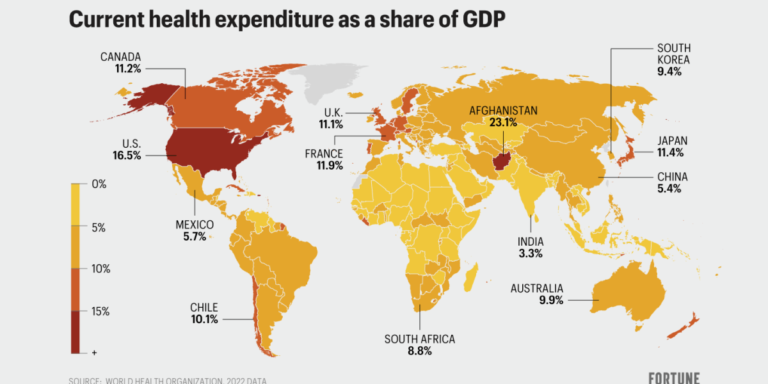

Regardless of the real feelings of Trump, the data suggest that Americans are more likely to change interest rates than swings in the stock market. Under 2023 Gallup, 10 Americans are six years old votingAlmost 80% of American households have a certain type of debt, respectively To the Federal Reserve. The 10-year yield has decreased about 50 base points since Trump’s inauguration, although it gave 4.30% Friday morning.

“More voters affect interest rates than S & P”, “Political Strategic and Venture Investor Bradley Tusk said FortuneA number of “but inflation throws dwarves both.”

It is not a fan of simple markets Tariffs uncertaintyAlthough the shares came back a bit on Friday morning. It remains to be seen that more defensive measures will lead to slow growth, higher prices, both of them (worst case scenario) or not. Even as many Americans have probably seen their 401K cost and there are signs that have already affected other pension plans in recent weeks.

Mortgage prices A month and a half fell before Freddie Mac weekly evaluate Thursday, although the agency says that the average 30-year-old mortgage rate decreased by 6.65% after the January 7% threshold was exceeded.

“Despite this minor blow, tariffs are still at the lowest levels, and if they continue to fall, can be launched a greeting stimulus, as the spring housing market is grew in many listing of bright MLS.

Mortgage Lower Payments cannot apply for nation structural Housing deficiencyBut they could offer homeowners who feel “is locked“2022 To obtain converted expenses to speech. Last week, the volume of mortgage loan bid increased by 11%. respectively The calculated index of the mortgage bankers association.

Why does Trump look at the 10-year treasury

The long-term yield is very interconnected with the loan interest rate for banks, which the Central Bank’s decisions allow the entire economy. Relations are not perfect, as a free-floating asset market like the 10-year treasury is also based on other factors, the head of Matthew Portfoli is the head of the income strategy at Alliansbernstein. He said that the role of economic growth, inflation and fiscal policy also play a role.

The yield, which represents the annual return of the investor, falls as bond prices rise and vice versa. This happens if investors believe that Fed will have to reduce the pace, which makes it more attractive on the existing bonds compared to greater bonds.

On the contrary, if concerns about the government Debt load Raising, investors can demand a higher return. In the last few months, Sheridan said that the investors of fixed income were less concerned about the federal deficite and are now more concerned about the economy. Originally, many traders thought that Trump would be focused on the growth of his agenda, such as tax cuts and prevents.

“I think that investors were a little surprised that the new administration prioritizes tariffs,” he said.

The Speaker of the White House said that the small rally of the bond market reflects the efforts of the new administration to restore “fiscal stability and trust”.

“President Trump has pledged to restore the fiscal reliability of our nation through reckless expenditures of the previous administration,” Harrison’s fields, the Deputy Special Assistant.

Marko grandfather, the main strategy of the BCA research said that it was wrong to assume that Trump was not ready to look at the instability of the past equity during his first term. After all, despite the president, citing the stock market work approximately once in January 35, in January 2018. one UnawareS & P 500 eventually decreased by 6% of that year because the first started Trump Commercial War With China.

“The President is Tweet about the prices of Tweets, when they rise,” said Grandpa, “he said.”

Some demographic materials tend to have Lower effect The Stock Exchange also appeared to shout Trump, who awarded Harris and his own 2020 performance in November, without college, and those who make up more than $ 100,000.

“They probably don’t think about the stock market but they [also may not be] To buy a new home in the market, “said Tusk, who served as a pre-election manager of Former Mayor of New York.

“But what they are doing is to buy foods,” he added, “or they may want to buy a new truck.”

Of course, it’s car loans, so rising inflation and possible prices, it says that the largest is the largest.

Correction: This story has been corrected to reflect that the Politician’s report found President Donald Trump, boasted for 35 hours in January 2018.

This story was originally shown Fortune.com