Why a 60/40 stock, bond portfolio needs a makeover

The President of BlacROCK and CEO Larry Fincan assumes tariff talks with China and the instability of the “Counting” market of “Claman”.

60/40 Portfolio, shares bonds have long been experienced and real methods, which build their pension nest eggs via the diversification network. But the times, they change, and Blackrock CEO CEO Cabin Finca advises makeup.

“The generations of investors have done well on this approach, having the entire market mixture, not individual securities. Fink wrote to investors in his 2025 letterA number

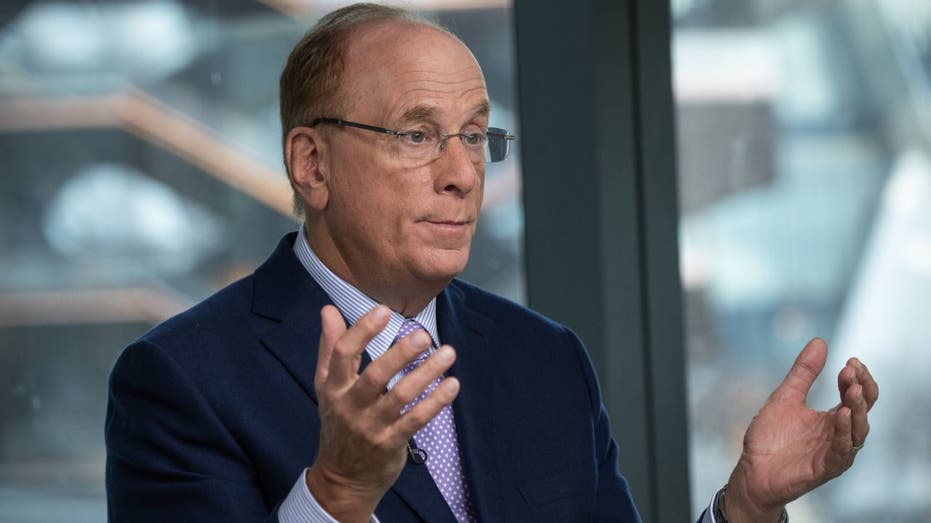

BlackRock Executive Director Larry Finc’s annual letter to investors

Larry Finc, Chairman of the CEO of “Blackrok” Inc. President and Chief Executive Partners (GIP) CEO in the USA, Friday, January 12 (Photographer, Victor J. Blue / Bloomberg Via Getty Images / Getty Images)

In the case of infrastructure, FINK gave the description of its inflation protection. He noted that the production of income, stability against unstable public markets and solid returns even as much as possible.

BlackRock recently paid $ 23 billion for Panama canals ports. As an example, income can occur through the water line by charging the paid fees.

BlackRock pays $ 23 billion for Panama Canal Ports

| Grieving | Safety | Last | Change | Change% |

|---|---|---|---|---|

| Hillock | BlackRock Inc. | 875.75 | +9.64 |

+ 1.11% |

Though BlackRock for more than 11 trillion dollars in assets The world’s largest asset manager is the 50/30/20 mixture or other split with alternative assets, can make sense for smaller, retail investors.

“For someone who has a lot of time and has assets to justify the features, we think that it is a really interesting opportunity to provide a denchfolio.” Katie Klingensmith:The main investment strategy of Edelman Financial Engines told Fox Business.

Mortgage interest rates due to market volatility

“In general, when we think about the construction of really strong portfolios for our customers, but when we think about what is best more interesting,” he said.

Is S & P 500, a wide range of US stock marketThis year has lost 10%.

Get Fox Business Go by clicking here

This year’s MorningStar’s main bonds are about 2%. According to the company, investment procedure, USD naming of US dollars with a one-year repayment period.