Trump tariffs lead to wild week on Wall Street

The President of BlacROCK and CEO Larry Fincan assumes tariff talks with China and the instability of the “Counting” market of “Claman”.

US financial markets have wrapped one of their most volatile weeks, because the 19th epidemic of Sovzy, as President Donald Trump quickly and angry with his tariff plan, which was harmed from China.

When the dust regulated, many major benchmarks have been recorded on Friday, which have increased weekly advancement.

| Grieving | Safety | Last | Vocation | Change% |

|---|---|---|---|---|

| I: Dji | Dow Jones Average Indicators: | 40212.71 | +619.05 |

+ 1.56% |

| SP500 | S & P 500 | 5363.36 | +95.31 |

+ 1.81% |

| I: Comp | NASDAQ Composite Index: | 16724.45559 | +337.14 |

+ 2.06% |

Dow Jones Industrial Mejor earned 5% per week, S & P 500 almost 6% and NASDAQ composite 7%.

The three main indicators remain negative for the year.

Volume and instability

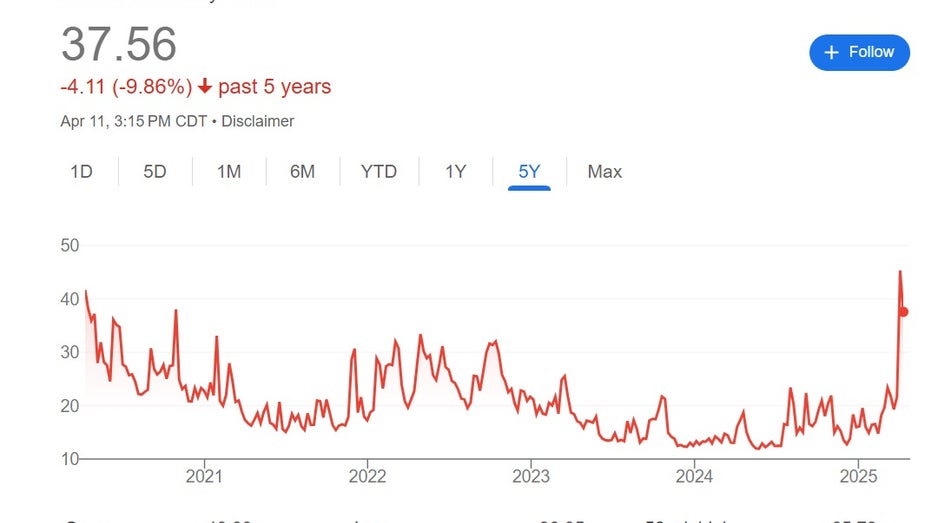

The final numbers did not come without a nail bite. CBEE instability index, which is also known as Wall Street’s fear measuring, hits a five-year high level, as Dow saw more than 2000 points over several sessions.

CBEE instability index (Court: Google)

In a panic in stock sales, experts say

Is Dow won 2,692 points on Wednesdayraising the largest one-day point in history. This day, the total volume of trade was approached by $ 30 trillion, the highest, at least in May 2019, as follows Dow Jones Market Data Group. This is the same day as Trump, a surprise core, stopped tariffs on some countries.

Dow Jones Industrial Medium:

A number

BlackRock Executive Director Larry Finc The market sail was mentioned by the conference with investors on Friday and said that it remains optimistic about the capital markets.

| Grieving | Safety | Last | Vocation | Change% |

|---|---|---|---|---|

| Hillock | BlackRock Inc. | 878.78 | +20.00 |

+ 2.33% |

“We do not see systemic risks that there is no epidemic,” Finc said. “The financial system is displayed safe and healthy and resuscitation. Markets trade more, more than liquidity.

Progress of tariffs

Meanwhile, the uncertainty about the tariff tested the contribution to the investor, the White House claims that transactions are made by the US Trade Representative Jamison.

“He confirmed that more than 15 proposals are already on the table, which is remarkable in just a few days. And as I said earlier, we have heard from more than 75 countries around the world.

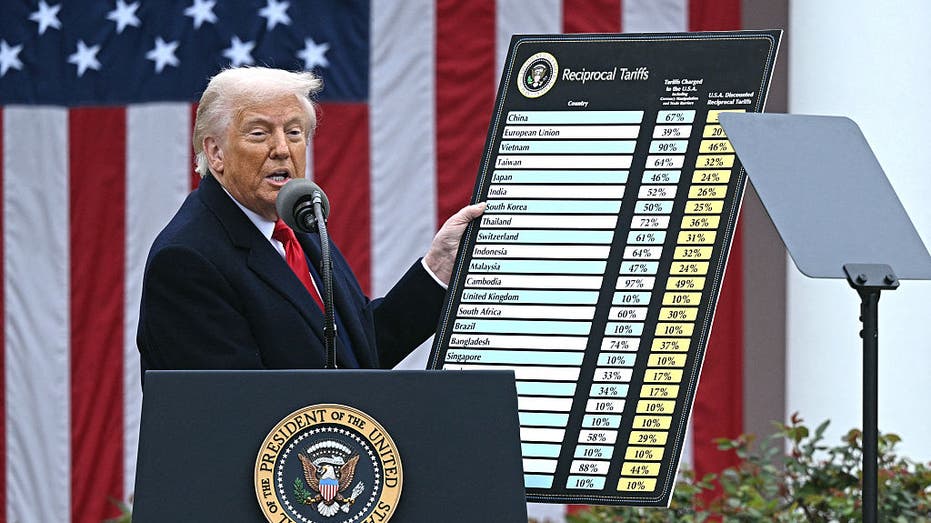

President Donald Trump is holding a chart, as he pays attention to the White House in Washington in Washington in Washington during the event on mutual tariffs. (Brendan SmiaSki / AFP Via Getty Images))

Bond market. 10-year treasury concession 4.5%

Government bonds more bonds a more disturbing signal because investors pull money about fragile decline concerns. When inferior, prices fall. The 10-year treasury, loans for loans, such as mortgage and personal loans, hit by 4.5%, the highest since February. The 50-PLUS base point of the week was the largest in more than 40 years.

Treasury Secretary Scott Bessent: Wednesday asked about this trend.

“There are many big, leverage players who have losses that have leverage,” he said to Maria Bartiromo during the interview with Maria. “I believe there is nothing systemic about this. I think it’s uncomfortable but normal deletion that continues in the bond market. “

Great banks are weighing Trump Tariffs. “Significant turbulent”

Batey was also asked about the weakening of US dollars and actions by the Chinese.

“They actually weaken their currency, which is losing to everyone. And again, when I hear all these stories, if there is no use that is ready to use their currency, “he said to me that it was a very good reserve tool.

The euro and Japanese yen make up 8% against greens.

US Fall.

A series of handful of Wall Street recruits disagreements that are possible to US. JPMorgan Chase Ceo Jamie Dimon shared his point of view this week.

| Grieving | Safety | Last | Vocation | Change% |

|---|---|---|---|---|

| Museum | JPMorgan Chase & Co. | 236.13 | +9.39 |

+ 4.14% |

“I’m listening to it now.” I will give it a little, I will wait, see what happens. ” It’s a kind of hounding talk, “Dimon said in an exclusive interview on Wednesday “With Maria’s morning.” To the question whether he personally expects a decline, Dimon answered. “I’m going to postpone my economists at this time, but I think it’s probably possible.”

His company transformed the likelihood of 60%, and Goldman Sachs now sees a 45% chance of one hitting America.

The consumer’s fears

The University of Michigan University of Friday reported that it The mood of the consumer This month, the figure fell until 50.8 from April 57, the fourth straight monthly decline.

“This decline was common and unanimously with age, income, education, geographical region and political affiliation,” said the surveys of consumers’ director Yanja Hsu.

The consumer mood was immersed in April. (Photographer: Patrick T. Folon / Bloomberg via Getty Images / Getty Images)

Relationship fears, tariff uncertainty quickly dive into consumer mood

“On December 2024, December 2024, the sentiment lost more than 30%, increasing the developments in the trading war, which range through the year.

Inflation

The March Consumer Price Index decreased by 0.1% against February, but remained 2.4% per year, with a 2% of the Federal Reserve.

While expenditures are ease of items such as eggs and the beef of untreated minced beef stay high, respectively, 60% and 10%, respectively.

Gold safe haven

The precious metal saw some instability this week, but expanded $ 3.222.20 ounces all time. The 7% profit of the week was the largest since March 2020. Even before the tariff wars, several strategists passed jackets on yellow metal, as well as traditional safe haven.

Gold fell $ 3.222222,22 throughout the time this week. (Photo by Arn Dedriti / DPA / AFP Getty Images / Getty Images)

Get Fox Business Go by clicking here

“Although inflation and real yields have been the main gold prices, the purchase of the Central Bank has recently appeared as primary catalysts, according to the current gold prices. The team sees Gold reaches $ 3500A number

| Grieving | Safety | Last | Vocation | Change% |

|---|---|---|---|---|

| Mill | SPDR GOLD SHARES TRUST – USD ACC | 297.93 | +5.62 |

+ 1.92% |

Berchauuk

The biggest cryptographic crypto on Friday, hanging out of $ 83,000. It is still under 21% to 21% from $ 206.734.51 to 2024 December 2024.