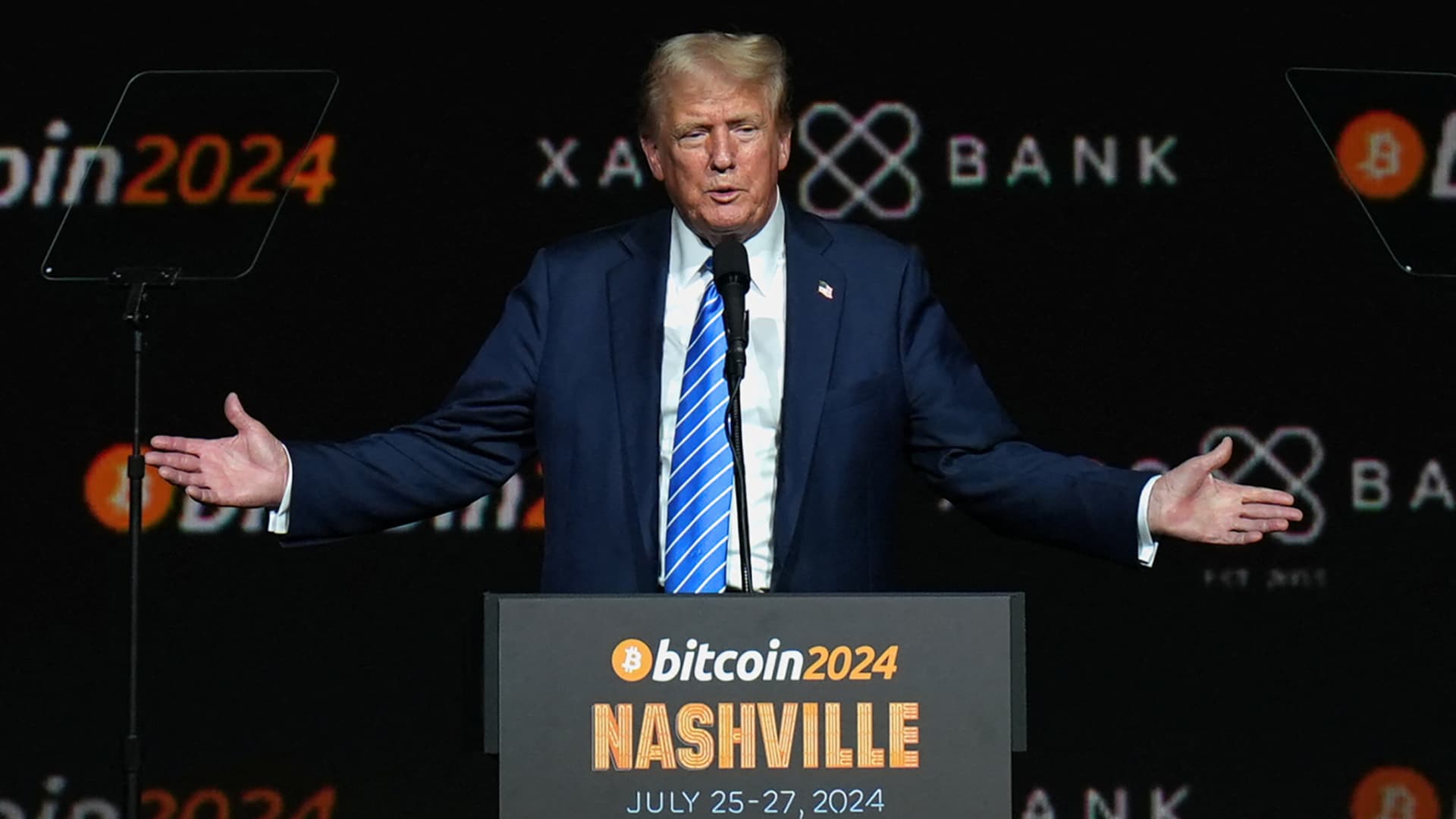

Trump Gets Wall Street CEOs Excited About Digital Assets in Crypto Plans

US President-elect Donald Trump’s Cryplocurrence with Cryall Trump’s Cryplocurrence Tokens on display at Coinhero store, China, January 20, 2025 at Coinhero store in Hong Kong.

Paul Yeung | Bloomberg | Getty Images

Only days President Donald Trump’s The second administration, Wall Street, sings a different tune to cryptocurrency.

“For us, the equation is really like one A highly regulated financial institutioncan act as a transactor” Morgan Stanley Director General Ted’s choice told CNBC on Thursday World Economic Forum in Davos, Switzerland.

Amidst a growing number of bankers in Davos this week, renewed optimism has been tied to Trump’s Crypto agenda. Trump, a vocal crypto skeptic in his first term, was flying During the 2024 campaign, he came to the issue and to trust Crypto industry money In his efforts to defeat former Vice President Kamala Harris.

President was given on Thursday Sweeper order in cryptocurrencywith an emphasis on “protecting and promoting” the use and development of digital assets. Banks are reluctant to support cryptocurrency and provide point-to-point transactions at this point due to the government’s stance. The SEC has brought more than 200 cryptocurrency-related enforcement actions since 2013, According to Cornerstone Research.

“We will work with the Treasury and other regulators to figure out how we can offer this in a safe way,” he said.

Trump has nominated many cryptocurrency advocates to critical positions in his administration. These include Paul Atkins, a commissioner under President George W. Bush who chairs the Securities and Exchange Commission. Cantor Cantor Fitzgerald CEO Howard Lutnick, Trump’s choice for Commerce Secretary, and hedge fund manager Scott Bessent, led the Treasury.

If approved, BESSENT will also oversee the IRS and financial crime network, which play key roles in shaping tax and compliance policy for Crypto transactions and establishing guidelines for Crypto adoption in the US.

Sechin says Morgan Stanley will work with federal regulators to determine if the bank can deepen its ties to cryptocurrency markets. His firm has been more aggressive than its Wall Street peers.

in 2021Morgan Stanley has become the first major US bank to offer its wealthy clients access to Bitcoin funds. Last August was the first major wall street player to authorize financial advisers Launched early last year, Bitcoin exchange exchile-trades funds to clients. To date, wealth management firms have facilitated trades if clients want exposure to the new spot cryptocurrency.

The choice suggested that the more Bitcoin enters the mainstream, the more it is viewed as a legitimate part of the financial system.

“The more he trades, the more perception becomes reality,” he said.

‘Just another form of payment’

Bank of America Director General Brian Moynihan If the regulatory environment changes under new management, it is ready to accept cryptocurrency as a specific, dedicated payment option. Speaking in Davos, Moynihan stressed that clear guidance could unlock wider adoption.

“If the regulations come in and become a real thing that you can actually do business with, you’re going to find that the banking system is going to tighten up on the operational side,” Moynihan said. Meeting with CNBC on Tuesday.

Moynihan, who runs the second-largest bank by assets in the U.S., noted that cryptocurrency could be “another form of payment.” Visa, MasterCard or Apple To pay. However, he refrained from discussing cryptocurrencies like Bitcoin, calling it a “separate question”.

Another major roadblock to Wall Street’s adoption of Cryptocurnales has been an accounting rule issued by the SEC in 2022, requiring banks to classify their cryptocurrencies as liabilities on their balance sheets. The rule made those assets subject to strict capital requirements, significantly increasing the financial and regulatory risks of cryptocurrency storage services.

Efforts to repeal the rule, known as SAC 121, won bipartisan support in Congress last year. However Then-President Joe Biden He vetoed the proposed legislation, leaving the rule intact and further discouraging banks from accepting digital assets. Banks are largely prohibited from expanding their crypto offerings beyond offering Trades and ETFS to their wealth management clients.

“Right now, in terms of regulation, we can’t have” Bitcoin, Golden man Sachs CEO David Suleiman told CNBC in an interview in Davos this week. He said the bank would revisit the issue if the rules were changed.

Thursday, sec was cancelled SAB 121 potentially opens the door for banks to own cryptocurrency assets without such onerous capital requirements.

“Bye, Bye Sab 121! It wasn’t fun,” he said. SEC Commissioner Hester Peirce, who On Tuesday has been tapped to lead a new “crypto task force.” x in x Thursday night after the verdict.

Bitcoin posted broader gains on Monday on the cryptocurrency of Trump’s inauguration. By mid-day Friday, it was trading at around $106,000.

– CNBC’s Hugh Son contributed to this report.