The CEO is faced with fraud after AI shopping app is claimed to have been found with people

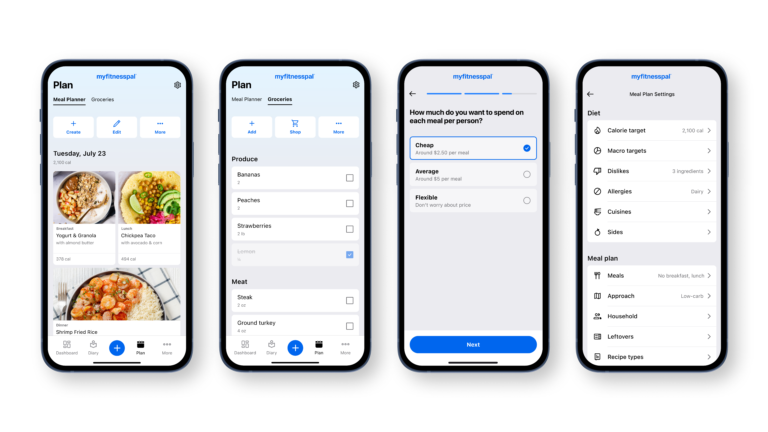

The Ministry of Justice has charged An investor fraud founder after his AI shopping application is claimed to be nothing more than a few people in Trenchot. NATE offers a mobile app that promised users a click to check every e -commerce website “without human intervention”, effectively, which means they can store their credit card and delivery information with NATE instead of entering it on any website. But prosecutors claim that the company relies almost entirely on human workers to finish Cassie. Well now.

According to the prosecution, the actual percentage of Nate automation was effective zero. Instead, the company relies on hundreds of human contractors in a call center located in the Philippines to make actual transactions. Perhaps from AI, the company actually refers to Asian intelligence. Nate raised over $ 50 million between 2018 and 2021.

The information first reported Concerning the allegations against Nate and its CEO Albert Saniger in 2022. Here is an excerpt from the report:

To process transactions automatically on retail sites without the help of people, NATE software is needed to understand how to find specific buttons on the page, such as the one that adds an item to the shopping cart without being blocked from the site trackers looking for automated bots, two people with direct knowledge of technology stated. That turned out to be difficult.

As a result, in 2021, the proportion of transactions, which NATe manually processes between 60% and 100%.

When Paul Hudson from Glade Brook went to order a pair of Levi jeans from the denim manufacturer website using the Nate box office, writes Saniger in a corporate channel called “VIP-Notificaitons-For-Albert” to warn that the transaction is necessary for the transaction.

Many AI companies still rely on people to some extent, especially to validate data generated by an algorithm, with the hope that AI will soon be able to absorb. Hot startups like Scale AI are scandalous for reading cheap farms to mark data and correct the results of AI models. Evenup, Startup who says he uses AI to automate the process of writing legal claims has been By relying on people Until recently, at the end of last year to correct the texts generated by AI. The most successful startups of AI so far are those who make tools, and the main acceptance of AI by enterprises remains the sign of fears about reliability.

Where Nate seems to have fallen into hot water, it explicitly claims that people have almost never been used in the cashier process, which is grossly false. Perhaps the company thought it could “fake it until you do it” and just exhausted the time for the product to work as intended. But it also entered an incredibly crowded space, with Amazon dominated by e -commerce and other companies such as Shopify, presenting its own one -click inspection products. It is also difficult to see how Nate could grow a business around a relatively simple function. Similar companies such as Bolt, another startup for checking with one click, only succeeded Generation of revenue from revenueS

Nate that still seems to exist, relies on strong To try and increase your app, offering the influential opportunity to create lists of your favorite products in the app and get an abbreviation from each sale.

Quite funny, however, Nate may have been something with his product. Amazon, Openai and Google are among the companies that have recently introduced “agents” that offer on the market as able to automatically perform tasks, including online users shopping. The products remain nascent and consumers complain that they are slow, expensive and buggy. They present some potential for automation of difficult tasks and make the calculations more accessible to demographic data like the elderly.

No one should show much sympathy for Nate private investors, seemingly experienced risk capitalists who have been entrusted with billions of dollars from the likes of pension funds and are expected to conduct an extensive check before investing. The risk capital model settles on home runways, with the expectation that most investments will reach zero.

Saniger faces a number of securities fraud and a number of wire fraud, both of which can lead to up to twenty years in prison.