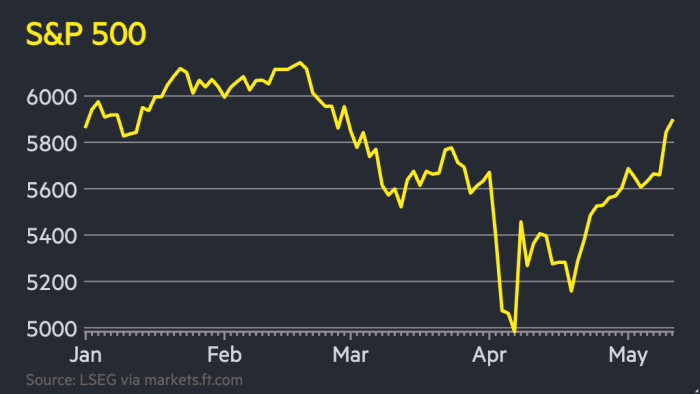

S&P 500 wipes out 2025 losses as stocks extend rally

Open the Editor’s Marking Free

Rulla Khalaf, the FT editor, chooses its preferred stories in this week’s news.

US shares have so far deleted their losses, as it is low on Tuesday than the expected inflation indicators, the VSP meets the rally President Donald Trump’s deal to reduce tariffs.

S & P 500 shuts 0.7 percent higher than data that indicates us unexpectedly Falling up to 2.3 percent in AprilDuring this month, the move extended a strong answer and left Wall Street’s standard above 0.1 percent for 2025.

The growth of tension was already insulted US stocks before Trump’s Liberation Day Tariffs sent to S & P Tumbling – 20 percent down to US assets.

But traders are reserved for April 9 in stocks when S & P flew 9.5 percent when Trump stopped his “mutual” Tariffs: During the majority of countries in 90 days, they continued to refrain from US shares.

The shares increased by 3.3% after Monday, after the United States and China noted that the tariffs will be cut off in 90 days following the week during the week.

“In the overcoming trends of the last few months, there was an instant reversal,” said Shep Perkhins. The agreement was “a big positive surprise and came about a fairly heated mood for US joint stock markets,” he added.

Investors have rushed to review their assessments of economic damage from a commercial war. Goldman Sachs raised its forecast for US earning growth and the end of its year, tariff transaction, “lower tariff interest rates, less economic growth than we used to wait.”

Technical shares, which were among the largest victims of April in April, received Tuesday. Chipmaker Nvidia rose by 5.6%, Palantir’s intelligence group bought 8.1 percent and Super Micro computer jumped 16 percent, as the NASDAQ composite index rose 1.6 percent.

Real estate and health shares have suffered the biggest decline, after which the United Kingdom is 17.8 percent quitA number

Despite the recovery, US shares continue to back down to large markets in Europe, where the Stoxx Europe 600 index has increased more than 7 percent this year. However, the 300 China CSI benchmark remains in a negative area.

Some analysts have caused us to pay 30 percent of the United States for imports from China to 30 percent, and at least 10 percent more than Trump than levels.

“It is possible that the stress caused by the solvents may be in the margin, but it does not strengthen the economy or does not remove the global slowdown, which has already taken a strategic recognition of BCA research.

He added that the global 10 percent tariff rate will still be “stagflationary drag”.