S&P 500 Sees Worst Fed Day Since 2001; Yields Up: Markets Wrap

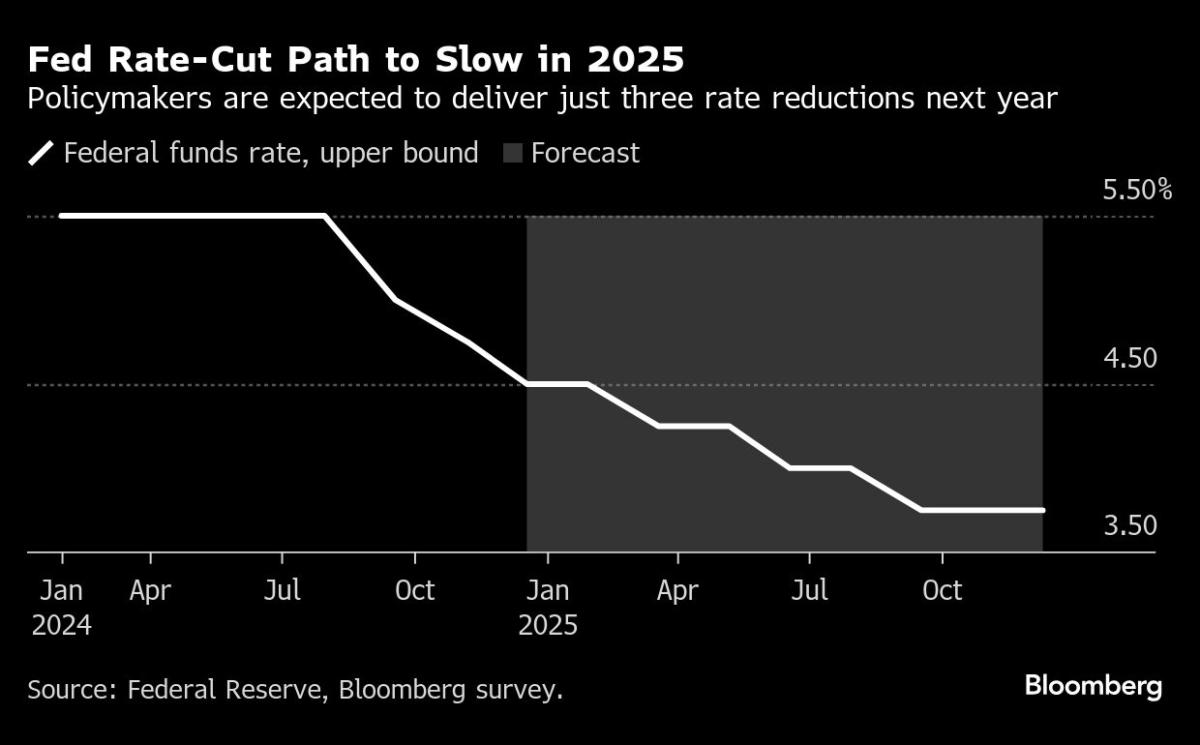

(Bloomberg) — The Federal Reserve rattled U.S. markets on Wednesday, sending stocks lower and Treasury yields higher after predicting fewer rate cuts next year.It was the worst rate-setting day loss for the S&P 500 since 2001.

Most Read from Bloomberg

The S&P 500 fell below 6,000, suffering its worst session since August.The tech-heavy Nasdaq 100 fell 3.6%, the most in five months live after the income statement.

Subscribe to the Bloomberg Daybreak podcast on Apple, Spotify, or wherever you listen.

The policy-sensitive two-year U.S. Treasury yield rose 10 basis points to 4.35% and the 10-year yield rose to a level last seen in May.The Bloomberg Dollar Index hit its highest since November 2022.

Although Jerome Powell made a widely-expected quarter-point rate cut after the Federal Open Market Committee meeting, the central bank signaled growing caution about inflation, including a reduction in how far members expect to ease in 2025. Powell reiterated that the central bank is more will be cautious as it considers further policy rate adjustments and says the Fed remains committed to its 2% target.

“We have to see progress on inflation,” Powell said. It’s kind of new. We moved fast to get here, but moving forward, we’re moving slower.”

The pace of Wednesday’s decline matches the pace at which the Fed turned to a bearish inflation stance.The S&P 500 rose more than 10% prior to the last session following the FOMC’s July 31 rate decision, in which the central bank backed off. from a one-sided risk assessment and said that expanding the labor market has become a higher priority.

In a briefing Wednesday, the president also said some politicians had begun to factor into their projections the potential impact of higher tariffs that President-elect Donald Trump might impose, but he said the impact of such policy proposals was highly uncertain at this point.

Max Gockman, a senior vice president at Franklin Templeton Investment Solutions, called Powell a “hawk in dove’s clothing.”

“Despite downplaying the recent slowdown in inflation, while boasting about the strength of economic momentum, he still hinted that tariffs would not go away as a blip, and that the forecast of two cuts for 2025 is necessary as policy must remain restrictive,” he said.

The last time the S&P 500 saw losses of this magnitude was on September 17, 2001, when the index fell nearly 5%. one day after the system’s emergency weekend meeting.