Republican senator backs Powell over Trump attacks on Fed

Open the White House viewing newsletter for free

Your Guide to What is the US 2024 Choice for Washington and the World

The Republican member of the Senate Committee, which controls the Federal Reserve, has reached Jay Powel, saying that no president has the right to fire the head of the US Central Bank.

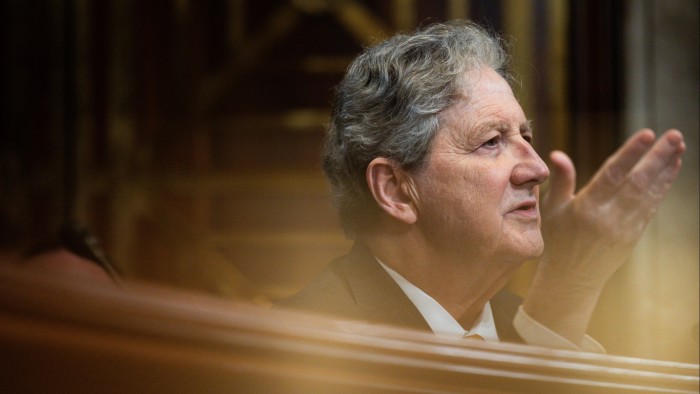

“I do not think that the president, any president has the right to remove the Federal Reserve,” said John Kennedy, who was sitting on the Senate banking committee. “I think that the Federal Reserve should be independent.”

Signs come right after Trump signals he thinks he has the right to fire LuxuriousTelling reporters at the Oval office on Thursday:

The US President and the Central Bank Chairman and the Central Bank’s Chair of the Central Bank have gone bankrupt against the Federation to reduce interest rates, as Trump returned to the White House in January.

Evaluation settings, including Powell, say that Trump tariffs threaten to increase dental growth and prices, describing his leader as a “difficult scenario” on Wednesday.

The speech of the Chair of the Magi, who promised to hold office until its expiry until its expiry in May 2026, touched the truth in a social way, saying that “Powell’s termination cannot come quickly.”

On Sunday, Kennedy protected Fed’s attention to inflation, saying:

Inflation Personal consumption costs Since 2022, he has been hit by his highest level since the beginning of the 1980s and remains at the top 2% goal of the Central Bank, 2.5 percent.

Some Officials: The Central Bank believes that tariffs may advance the annual price of up to 5 percent to 5% later, the scale announced on April 2 must be won.

On Sunday, CBS President Auusta steam said that the Central Bank told the Central Bank that many businesses are making “product preventive purchases”, which can affect tariffs, which means “activities can look artificially high.”

When Trump’s attack on Powell, Sangu said that in countries where the independence of the Central Bank was challenged, “inflation is higher, the growth is slower.”

“I strictly hope that we are not moving to an environment, where we question the monetary independence,” Golsbi said. “It will divide the reliability of nutrition.”