Fresh wave Tariffs: From the president Donald Trump – Despite the temporary period of many, it unleashed chaos in global markets, rejuvenating the tension and investors. But the manager of the billionaires fence Ray Dalio says that the real storm still has to come.

April 7 in long-term social media postingDalio claims that the latest tariff drama is just a symptom of deeper, structural problems.

“We see the classic division of basic monetary, political and geopolitical orders,” he wrote.

Dalio outlined five strengths described as a transformation of a world landscape.

1. World Money Procedure

Dalio said that the global economic procedure is being demolished due to the unstable debt of the debtor and deeply imbalances, such as the United States like China’s creditors and creditors. Since these imbalances are demolished, Dalio warned that the current monetary order will have to change “in large disruptive ways” for capital markets and a wider economy.

2. POLITICAL ORDER

Dalio sees the political order of democracies, which is destroyed by what he calls “huge gaps” at the level of education, income and opportunities, as well as values. He said that history shows that such an environment often provides a “strong carous leaders”, especially when combined with economic and market turmoil.

3. The structure of global energy

Dalio was at this point. He claims that it is replaced by “one-way, power rules” approach. Before the United States remains the most powerful nation, Dalio said that it now operates more confidently, Ameria first.

4, 5. Nature and technology

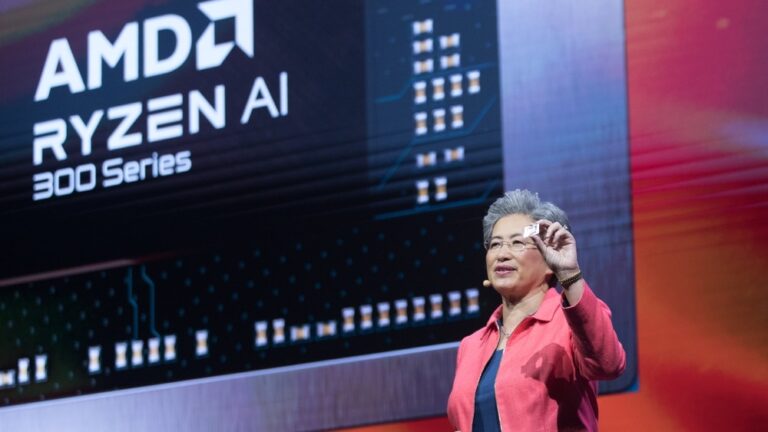

Dalio added that “the actions of nature”, such as floods and pandemics, become more disruptive, while the rapid advances of technology, such as artificial intelligence, affect “all aspects of life and the costs of nature.”

Taking into account the magnitude of these forces, Dalio warns readers who do not focus solely on tariffs.

“I urge you to prevent the dramatic changes, such as tariffs, focus on these five great forces and their relationships, which are the real drivers of the major cycle changes,” he wrote.

It does not mean completely ignoring tariffs. Instead, Dalio urged readers to look at how events like Trump Tariff Action through all five systems: monetary, political, geopolitical, environmental and technology.

Read more: Exploded by the US stock exchange “Fear Measure” but this 1 “Shockproof” asset is 14% and helps US retirees stay calmA variety is how to have it asap

Dalio did not offer special investment advice to his position. But in the February interview with CNBC he noted the importance Diversification and pointed out the role of the asset tested once.

“As a rule, people do not have the appropriate amount of gold in their portfolio,” he said. “When bad times come, gold is a very effective diversion.”

Gold is considered safe safe asylum. It cannot be printed like a thin air like Fiat and because it is not connected with any currency or economy, the investors smell it in economic turmoil or geopolitical uncertainty. In the past 12 months, gold prices have risen by about 35%.

There are many ways to get gold influence today. Investors can buy Gold Bullion – Some online platforms offer a choice Gold and silver bars and coins – Shares of gold mining companies, invest in gold and even Tap potential tax advantages through Golden IRAA number

Many experts, including Federal Reserve Chair Jerome Powell and JPMorgan Ceo Jamie Dimon, warned that Trump Tariffs can cause eght Significant increase in inflation.

While gold remains a classic fence, real estate offers a test-tested alternative to the additional benefit benefit.

When inflation rises, property values often grow, reflecting the higher price of materials, labor and land. This makes the real estate a forcing store for investors who want to protect their wealth.

Moreover, real estate not only relies on the return assessment. For example, lease properties can provide a stable flow of passive income. As inflation pushes the value of living standards, the rental income is usually besieged to it by helping the hosts compensate for the purchasing power erosion.

These days you do not need to buy property for real estate investments. Crowdfunding platformsFor example, allow daily investors to have shares with properties without large payments or management heads, which are traditionally related to real estate ownership.

Alternatively, Real Estate Investment Trusts (Screws) Provide another avenue for those who want to be subject to this asset class.

This article only provides information and should not be interpreted as advice. It is provided without any guarantee.