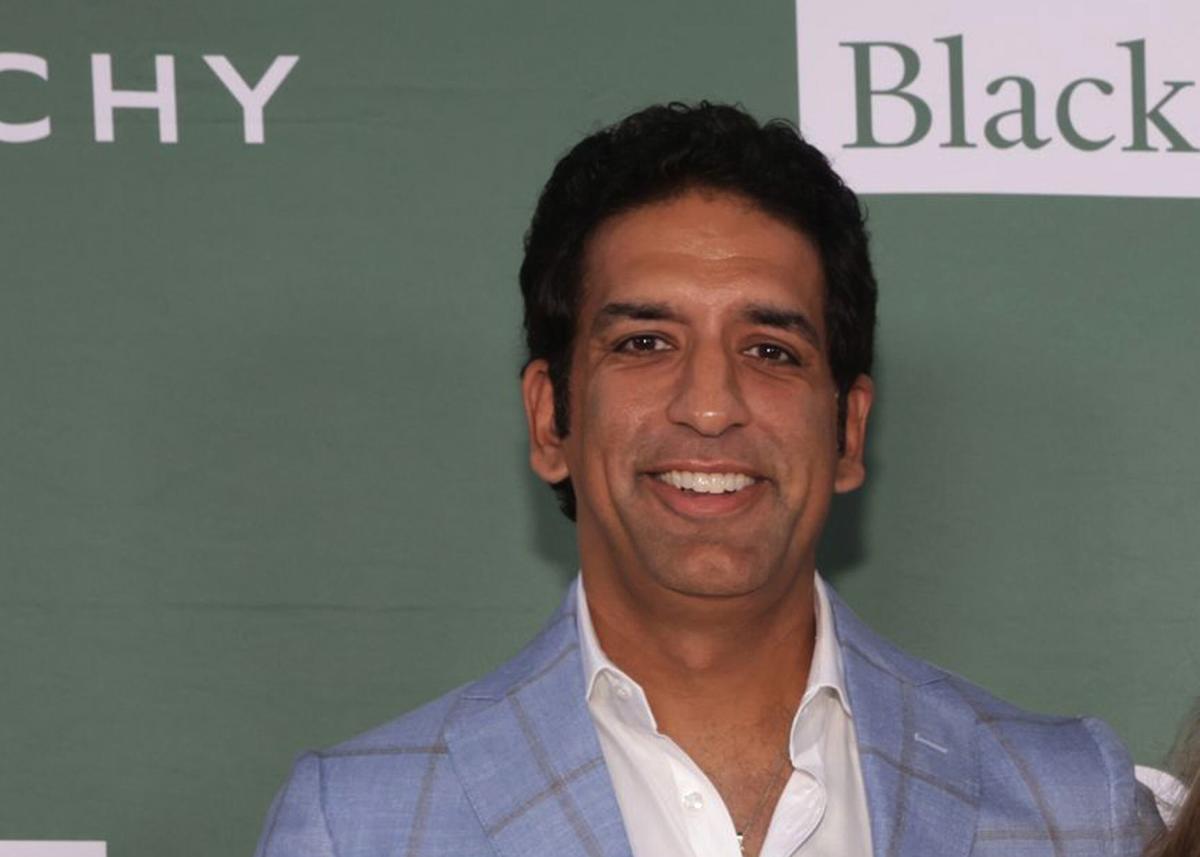

Omeed Malik’s SPAC Said to Near Deal With Gun Retailer GrabAGun

(Bloomberg) — Omeed Malik’s special purpose acquisition Colombier Acquisition Corp. Company II is close to agreeing to merge with online firearms retailer GrabAGun, a deal likely avoided by many other Wall Street investors on ESG principles.

Most Read from Bloomberg

The deal values GrabAGun at about $150 million and could be announced as soon as Monday, assuming talks don’t fall apart at the last minute, according to people with knowledge of the matter who asked not to discuss confidential information.

Malik, a former executive at Bank of America Corp., is chairman and CEO of Colombier.He is also the founder of commercial bank Farvahar Partners and investment firm 1789 Capital, which has a mandate that includes environmental, social and supporting companies affected by investment management principles and in a parallel economy consistent with conservative values.

Malik’s first SPAC merged with PSQ Holdings Inc., owner of the online marketplace PublicSquare, which aims to connect “patriotic” consumers and companies like EveryLife, a tissue maker that describes itself as ” pro-life.” He was part of a core group of campaign financers for President-elect Donald Trump.

PSQ launched a payments company in October and expects to process more than $1.8 billion in gun and firearms transactions by 2025, a person familiar with the matter told Bloomberg.Last month, PSQ appointed Donald Trump Jr. to its board. who is a partner in 1789.

Dallas-based GrabAGun, led by CEO Mark Nemati, is profitable and on track to generate roughly $100 million in revenue by 2024, the people said.The company, which was founded in 2011 and sells firearms, ammunition and other apparel, cites the Second Amendment on his website and says he believes it is his “American responsibility” to help consumers understand and legally secure their firearms and accessories.

Representatives for GrabAGun and Colombier declined to comment.

Colombier, based in Palm Beach, Florida, raised $170 million in an initial public offering in November 2023. Its shares closed Friday at $11.79, giving it an IPO market value of about $200 million. In a filing earlier this week, the company said it could focus on opportunities, including “areas with undervalued value due to some investor mandates.”