March inflation drops to lowest point in more than 3 years

Egg prices continue to grow, but inflation moves in the right direction. BootyreservoirIn the case of

Consumer prices fell 0.1% according to Consumer Price Index (CPI) released by the Bureau of Work Statistics (BLS). This is the first monthly decline since July 2022.

The annual inflation increased by 2.4% compared to 2.8% growth registered in February. Basic inflation, which excludes volatile energy and food prices, increased by 2.8% last year, the smallest 12-month growth in March 2021. Martin food, however, increased by 0.4%. During the last 12 months, meat, poultry, eggs and egg index rose by 7.9%, and only the price of eggs was thrown at 60.4%.

Inflation continues to move to the 2% target rate of the Federal Reserve. Still the impact of the new tariff events of President Donald Trump can distort this progress and hinder the economic growth, according to Jim Baird, Plant Moran’s financial advisers.

“As consumers who can affect prices on prices on prices and discretionary products, there is significant uncertainty about the impact, although it is directed for everyone. “It has been sent to economists to update their predictions to reduce growth and increase the expected inflation for the year.”

Despite concerns about the consequences of President’s Top tariffs, Fed continues to keep stable interest rates stableAnd soon it is not expected to make any significant changes, including the possible interest rate. Although tariffs can lead to higher inflation and slow economic growth, Fed is waiting for more clarity before making any decision of the decision.

If you are fighting with high inflation, consider taking a personal loan to pay lower interest debt, reducing your monthly payments. Visit trusted your personalized interest rate without affecting your credit score.

Mortgage prices have fallen below two months this week, remain at 7%

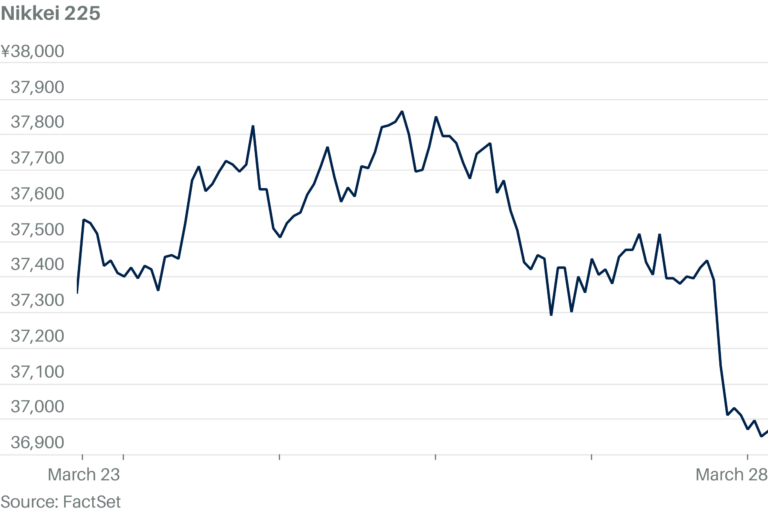

The rattessia risks grow

President Trump tariffs also contribute to the risk of decline. Several large financial institutions, including Goldman Sachs and JP Morgan, have raised the odds of their fall. According to Baird, part of the problem is that due to tariffs, prices rise, consumers can decide to restrain their expenses.

“In recent months, the mood has fallen, and there are already not only more careful mood, but also more severe expenses,” Baird said. “Prices can rise, but it does not mean that consumers will pay any price for any product. Some can push, but many are more cheaper than to delay in alternative shopping or delay in discretionary purchases.

“This reality raises the likelihood of a more remarkable slowdowning of the economy, the risk of recession is also growing,” Baird continued.

You can take a personal loan before future exchange rate campaigns to help pay high interest rate debt. Visit trusted your personal loan interest rate without affecting your credit score.

California homeowner’s insurance industry stands ahead of a rough road, as fires continue

Spring home season looks promising

From 4.2% of February, it was reduced to the inflation of the March Shelter. It is good news, as the prospection of asylum is the main force to raise inflation in recent years and can help move the needle to interest rates.

Mortgage rates continue to overthrow, the rest pass by a 7% in the twelfth week and can stimulate spring sales, Freddie Mac is the main economist.

“Because the purchase applications continue to rise, the spring home season is formed to look more favorable last year,” Khatter said.

FREDDIE MAC Mortgage for the last ending week of Freddie Mac was 6.62% Mortgage Primary Market Research. It decreases last week when an average of 6.64% and lowered 6.88%, it was a year ago.

“Unfortunately, inflation remains painful, on top of 2% of the role of rates for lowering pace,” said Gabe Abshir, moving to the General Director of the Door. “Taking into account the housing sector, it has a lower global trade environment, it will be useful to reduce the pace to Fed and the market and summer house purchase market.

If you want to become a homeowner, you can find your best mortgage prices through shopping. Visit trusting your options without being affected without your credit score.

FHFA announces higher mortgage bounds for 2025

Have a matter of finances, but they do not know who to ask. Too. Email Expert by Mail MoneyExpert@creedible.com And you can answer your question in our trusted monetary expert column.