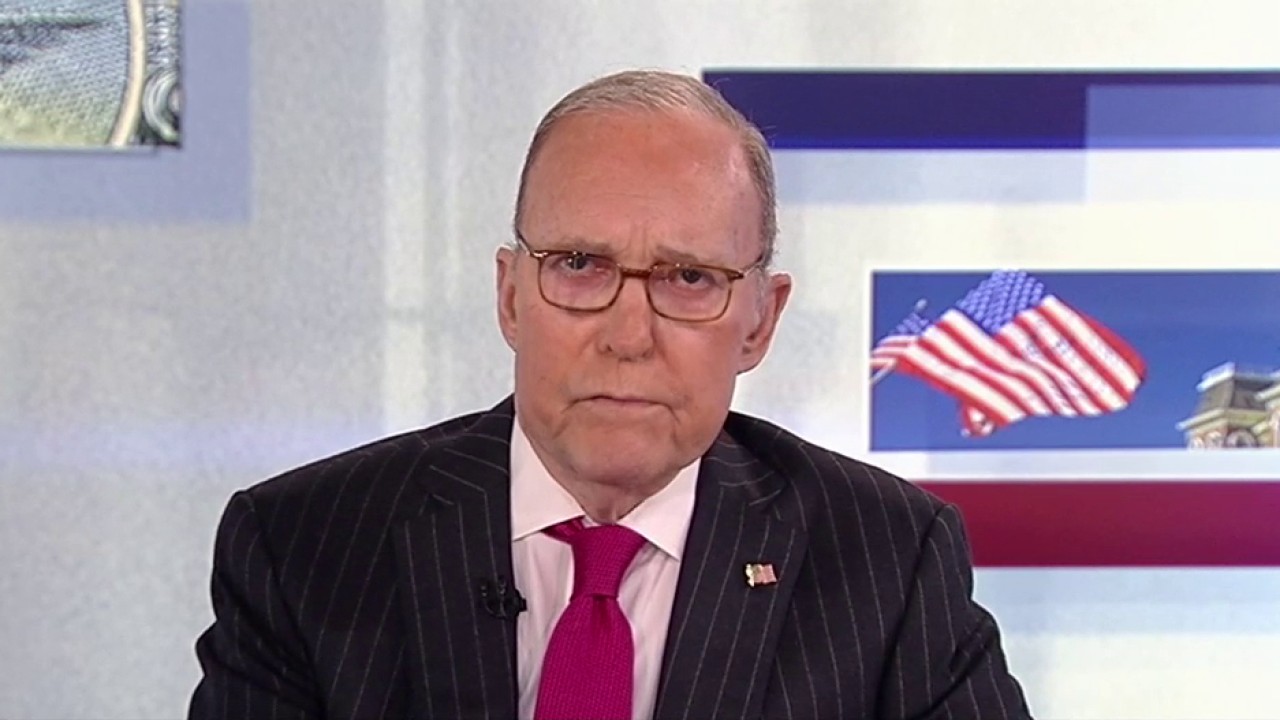

LARRY KUDLOW: Fed chair Jay Powell gets it right, one time in a row

With all of the Federal Reserve Chair Jay Powell, I have been to his hardest criticists, as the inflation history is completely wrong when they poured into the money supply and, in fact, went to $ 5 trillion of Joe Biden. Federal expenses and deficit and debtA number

Fed first denied that there was a problem with inflation. Then they insisted that it was a transition. And when they turned their foot on the brake, the cat out of the bag to 9% inflation.

Prices increased by more than 20% during Biden’s term, while salaries have greatly increased. Therefore, the rebellion of all colors and layers of work order peoples. Selected Rebellion President Donald TrumpA number

All that said: Jay Powell at today’s press conference He spoke very sensible and seem to have history on tariffs and inflation.

As I mentioned, it can be the case that it is sometimes advisable to go through inflation if it quickly leave us if it is transition. And it can be in case of tariff inflation.

Today is the most overrated topic in Wall Street Trump Tariffs are prepared for inflationaryA number will not be.

Powell is right. Any Rising prices will be transitiveA number

Think like this. If the price of the washing machine rises due to the tariff, and the family goes out and goes on a car, but at a higher price, but will spend less money on other things.

The price of the washing machine will rise, but some other price or prices will decrease. It can mean that the family will not buy a television set or a computer or something else.

Thus, one price rises, families spend less on another good, and that other price is down. But the total consumer prices rate does not change 80,000 items.

That’s what makes him transition.

The director of the National Economic Council Kevin Haset is missing President Donald Trump for economic policy towards Kudlu’s economic policy.

The only way for individual price can lead to common overall inflation if Fed turns to the print press, or if the federal government goes to the expenses. If that happened, the total inflation will rise, whether there are tariffs or not, as inflation is fundamentally monetary.

By the way, if Fed mistakenly applied to the printing presses, the dollar returned. And this will also increase the entire inflation index.

Now, at the moment, although Fed targets the interest rates on dollars or foreign currency, it should be noted that the price of gold is $ 3,050 today. It’s a warning to Fed to keep their cash powder dry.

And Jay Paste seems to be the drying of monetary dust. How did he say today? “We don’t need to hurry to settle our policy.”

It’s Fed-Speed. The Central Bank does not reduce interest rates or increases the monetary supply.

The Fed also announced that it would continue to reduce its holding treasury securities and mortgage bonds, although they will slow down the pace of the fall soon. But that’s a good thing, because it will keep the money supply, which means that inflation must remain check.

All this suggests that Wall Street and Liberal Media Hysteria on inflationary tariffs are very HOO-HA.

So I’m going to applaud Jay Powell because he got right. Once in a row.