‘It’s all engineered’: For US, recession isn’t a risk but a tool, warns Rivigo founder

“The United States has to have an accident to restore,” says Deepak Garg, the founder of Rivigo. And he bets the next one is not far away.

For the government’s debt for $ 9.2 trillion, which takes place in 2025.

“Most people do not understand that the United States must stop falling in 5-7 years to refinance all the unnecessary debt,” he said.

“In order to be able to sell those bonds, you will need a wretched drip. 50% +. Last week what happened is not enough, “the garg warns. “The 10-year yield in the United States is above where they used to be a tariff fear.”

Numbers draw a gloomy image. The $ 9.2 trillion matures for a total of 31% of US GDP for projected at a total of 36.2 trillion national debt in 2025. In about 6.5 trillion, it will be necessary to refinance in the first six months of the year.

Most of this debt has been given near zero interest rates. At the average exchange rate of the treasury, now is 3.2% since 2010. The cost of climbing is growing.

Analysts expect to jump in service costs 1%, as in 2024.

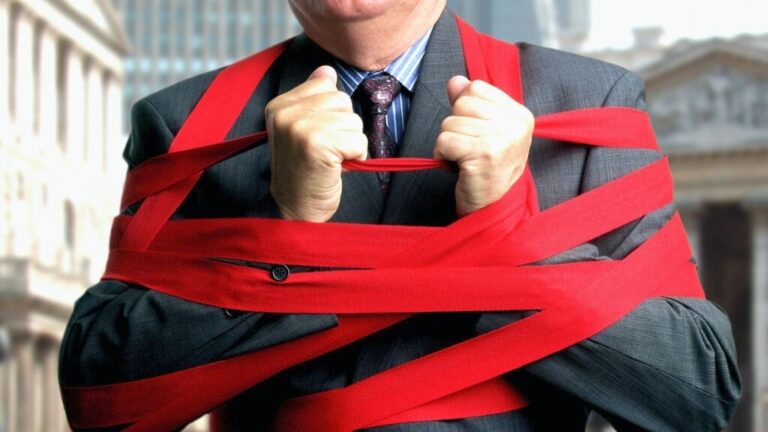

Policy options are fastening rapidly. Fed is under pressure to recover exchange rates to verify refinancing costs. At the same time, more issue of bonds could have been flooded markets and pushed higher.

According to reports, Trump’s camp stressed extreme measures from $ 758 billion gold reserves to use tariffs to use external debt.

CBO forecasts show a dangerous drift. By 20.4% of GDP increases by 18.3% by 18.3% by 18.3% by 18.3%. It leaves the expansion gap and growing interest as a delay.

Garg assumes that by 2033/34, or inflation will calm down the debt, the Ministry of Emergency Situations will promote productivity, or the heavy assets of gold and Bitcoin will hold the line. Until then, the decline can be politics, not by chance.