I’d Consider Buying the Dip on All “Magnificent Seven” Stocks — Except This One

After December 16 after the peak, NASDAQ COMPOSITE – What does the NASDAQ stock exchange cost almost all stock trades, entered a correction? The indicator drops about 9% per year and 13% of its December top.

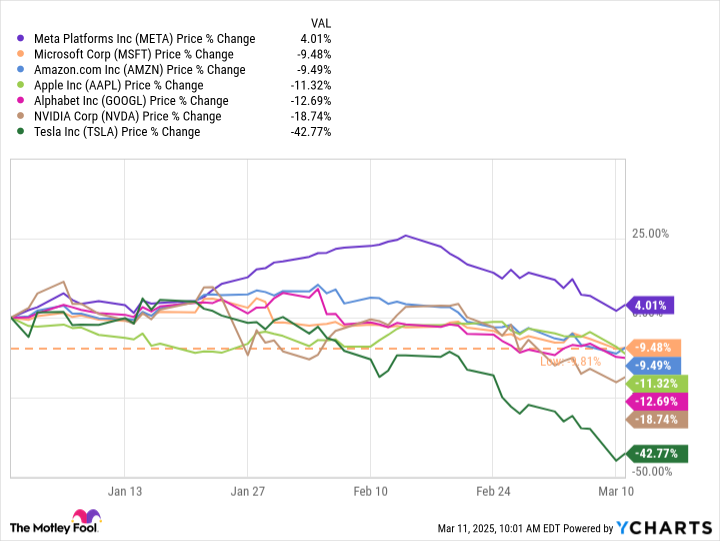

Consideration NASDAQ COMPOSITE Technical, it is not surprising that this year a lot of technological shares have followed a similar path. The “Majestic seven“That is given Apple (NASDAQ: AAPL)To be in style Microsoft: (NASDAQ. MSFT)To be in style Nvidia (NASDAQ: NVDA)To be in style Contricolative (NASDAQ: Amzn)To be in style Meta Platforms: (NASDAQ: Meta)To be in style Alphabet (NASDAQ: GOOG)(NASDAQ: Googl)and Visitation (NASDAQ. TSLA)Everyone is going down year by year, except for metha.

Meta data YchartsA number

I don’t see a decline in the seven shares as a panic button while you hit. They have experienced such a decline before, and for a long time, they will probably feel them at some point. If anything I watch it as a time when investors can take into account “Discount” shopping and start buying shares.

I see the appeal in almost all seven and take into account buying the dip on each. An exception, however, is a Tesla stock that I would personally be far away now.

For the remaining six shares of seven, there are growth drivers in their business and competitive advantages that go to the submerged price.

-

Apple is one of the most efficient companies in the world and has a rising sector, which is rapidly expanding from iPhone and other devices.

-

Microsoft has a broad technology ecosystem, which is necessary for the corporate and corporate life, as we know, and strategic partnership with Openai gives it to AI innovation.

-

NVIDIA Graphics Processing Units (GPUs) and other data center equipment are vital to the development of AI infrastructure, which will develop for a visible future.

-

Amazon has made progress beyond e-commerce, a leader in cloud calculations and develops a developing advertising business.

-

Meta is a huge digital advertising and great investments in its AI infrastructure to promote business and implement its metal vision.

-

The Alphabet Google continues to prevail the search, its cloud business continues to be steamed, and YouTube is a leader in the content of digital video content and developing flow.

Of course, they are simplified business analysis, but I’m more optimistic about their every trajectory than Tesla.

Rulenger’s electric vehicles (EVS) are accountable for most Tesla’s income, and many of those sales have an international level. Unfortunately, Tesla sales recently hit recently. In recent months, China, Norway, Denmark, Sweden and Germany are all cases of sales.