How much was Elon Musk’s pledge to step back from DOGE worth? $67 billion to frustrated Tesla shareholders

Even analysts’ coverage term Visitation He warned about the very disappointing results of Q1, a scene that is announced in early April from the poor poor shipping.

But on April 22, the numbers issued after the market were much worse than expected.

The automotive sales of the same period last year fell $ 14 billion in the same period last year. Despite the strong 12-month profit of its industrial and residential battery, the total revenue fell by 9%. Sales hammer yogurt yield Q2 Since 2023.

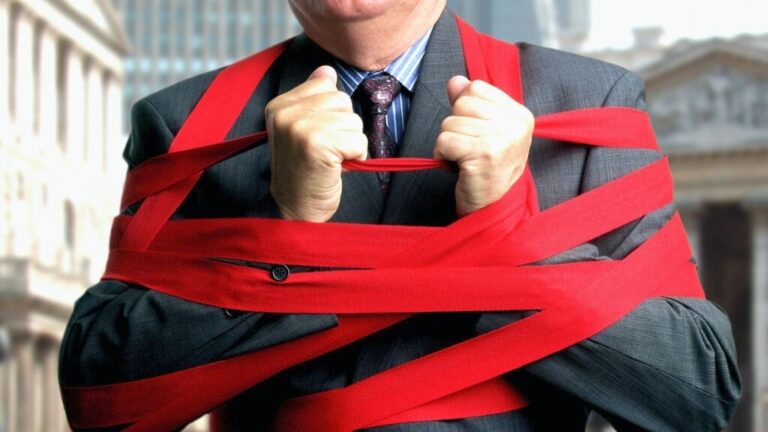

When the results fall into this catastrophic “agreement” “Agreement”, in fact, given that the mixtures of the stock are followed. But Musk staged another victory for the show to save the day. During the conference, he stated that he began in May, he will return to his role as President Trump Hawk, “Tesla is spread much more time.” The richest man in the world has also managed to divert the gaze of investors from the new promise of the new figures, stating that the long-term version of Model Y Sports Machine will arrive at the end of this year since 2026.

Thus, when the NYSE closing call sounded Thursday, Tesla shares from $ 260 to $ 260 to $ 260. Half of that day, Tesla added $ 67 billion in the market cap, increasing its evaluation – $ 836 billion.

Rub. Tesla’s stock has been radically overrated before this incredible scutor. That’s why.

In the past quarter, Tesla lost money in its “Hardkori” business

Tesla now produces in Austin, Berlin, and Shanghai explains only a small part of its assessment. And their fortune falls fast. The rest, which was simply presented against the debut of Q1, can be called “Hope of Musk”.

Following the bad Q4 report, this writer introduced a new concept of Tesla’s repeated, bedding measurement of Tesla, created by its current business, almost exclusively cars and batteries plus small services. In order to get there, I lifted such a single profit in the last quarter of 2023, and sheep profit, worth $ 600 million in the second quarter. I have also ruled out the sale of calculating loans, competing services to the papers, benefits he says that musk proves how quickly it fades to fade unpredictable.

What we will give to this “Hardcore” profit will show how Tesla’s giant market hat is justified what is now done, and how much is the “Musk Hope Premium” promises and trading robotaxies. So far, these assurances have proved the constant horizon.

To get the “Hardcore”, I started $ 409 million in net earnings and was removed from tax returns from the sale of regulatory loans. This result is $ 433 million, and more than 100% of Tesla’s total profit. In my calculation, Tesla lost $ 13 million in Q1 to sell and sell batteries. It’s the first time since 2020.

For the past four quarters, Tesla has posted “Hardaror”, I hope to “repeat” $ 3.5 billion. Therefore, it is currently sold in the 240 specified P / E (836 billion dollars appreciation divided by $ 3.5 billion in the amount of profit). By the way, in 2022, Tesla’s “Hardaror” for the year was almost $ 12 billion, three times that he arrived in the last 12 months.

Come on Car-Battery Business AP / E 20, twice the average industry’s average indicator is just generous. It puts $ 70 billion in its current value of its growing actions. The whole difference between $ 766 billion is a blind voting for confidence that musk will increase revenue for years from here, rarely witnessed capitalism and size player.

If you want to return 10% from here, Tesla’s shares will be doubled in seven years from today’s 260 to $ 520. Of course, the musk car reached almost a few months. But the future now seems to have a lot of atmosphere than done in the days following Trump’s election. Marking Meaning means Tesla’s market hat should double up to $ 1.6 trillion. A, once again, the generous forecast of 30 pts E, the required net earnings is $ 50 billion. Cars won’t do it. Tesla must earn half of Apple Now produces products that have not offered shooting boards and prototypes.

It seems that musk is again fog on investors

Tesla Q1 press release accuses “uncertainty in uncertainty in automotive and energy markets” [that] It continues to grow a rapidly developing trade policy, a negatively monitoring of the Global Supply Network and Tesla and Our Peers Expenditure Structure. ” In other words, Tesla accuses Musk boss White House.

In Musical Movie Music man, Slick Mankingman Harold Hill enchanted good political scientists in the mythical river city to pay tromibones and clarinets that were always going to arrive. Hill’s Wordplay inspired the Ghosts of the Glorious Route, which drunk his audience. The man’s man didn’t get anything on Elon Musk.

This story was originally shown Fortune.com