Fed’s QT pause, Treasury’s debt plans may offer fleeting relief to US bonds

With a brave beard

New York (Reuters) – Federal Reserve Balance and Treasury Secretary Scott Bait’s assurance to fight the permanent challenges of long-term debt is needed to release freedom.

The minutes of the federation lasted by the rates of the rates on January 28-29 have shown that the possible breakage or slack of the Fed’s balance, which is known as the debt capacity of the mandatory government can complicate the central bank’s liquidity. to measure. At the same time, in an interview with Bloomberg on Thursday, Bloomberg in the interview said that now the government is not to expand the service.

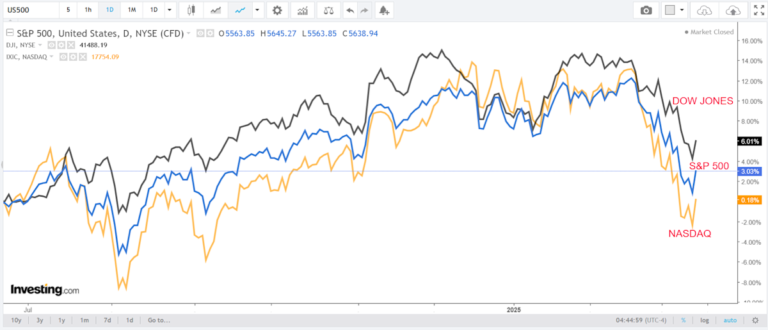

After Fedneday’s draw on Wednesday, the treasury yields gave treasury, and Bates interviewed further optimism, the low yield on Thursday.

His remarks have not yet affected the increase of public debt, as investors and analysts expect that the treasury must eventually be more compensated for the reduction of taxes offered by President Donald Trump.

BRIJ KHURANA manager’s Fixed Wellington Management Manager said that he encourages having the treasury “Who realizes funding costs?” Bessent said earlier this month that the 10-year treasury concession should contain the focus of the prolific prisoner.

“At the same time, if yield is financially low, they are probably going to make more tax cuts … If the yield is much lower, I think Baina will try to push longer bonds,” Baina said.

JPMorgan analysts say that the bond market concerns on Thursdays may be backed up on the supply of excess debt in the coming months, taking into account the administration’s attention with long-term yield. But they said they still expect that the government’s great government needs to increase the sale of long debts in the next fiscal year.

In 2017, during his first presidency, they plan to restore tax cuts and expansion. This may increase more than $ 4 trillion in the next 10 years, assessed the Congress Budget Office.

Federal expenses that are guided by Elon Muscial Government’s efficiency (DOGE), along with the potential income of Trump Import Tariffs, the growth of deficite can help, although their impact is uncertain.