Chinese Bonds Recover From Selloff as PBOC Steps Up Cash Support

(Bloomberg) – China’s government bonds have expanded the restoration after the Central Bank of the country, contributed to short-term funding support.

Many of Bloomberg read

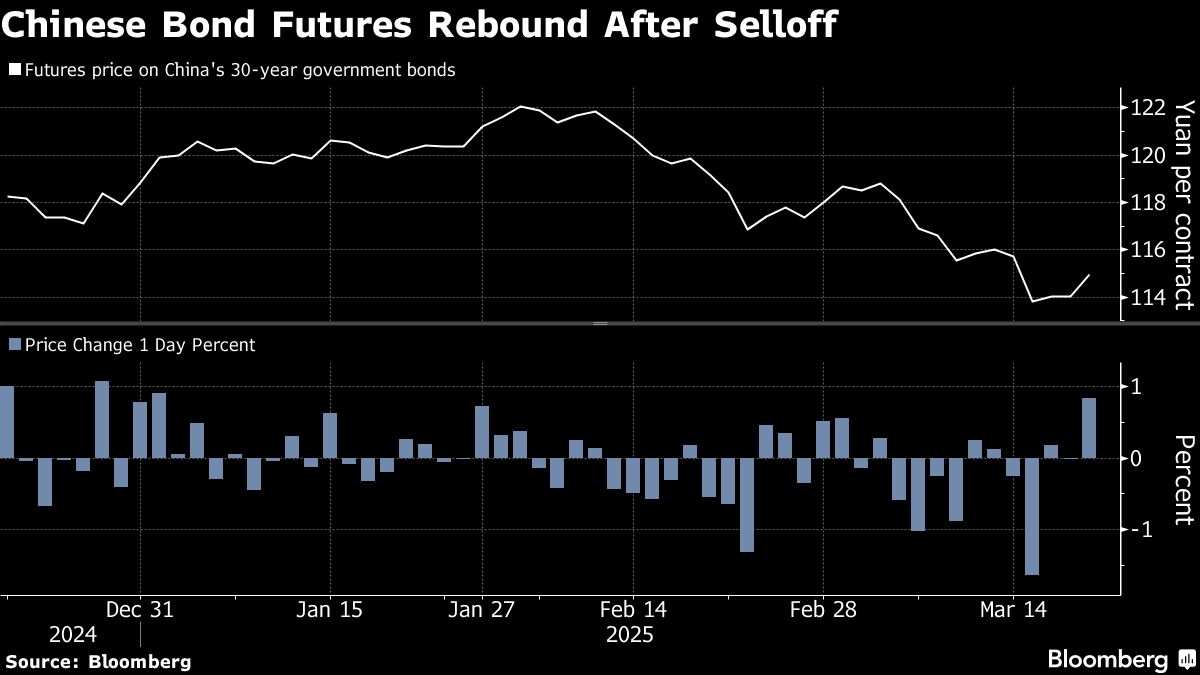

The yield of 10-year-old note has decreased on 3 bases, reaching 1.84%, noting from the third day of the decline. Futures of 30-year-old paper increased as much as 1%, at the end of December.

973.2 billion yuan ($ 134.6 billion) has increased by a net basis on a purely basis on a purely basis ($ 134.6 billion).

Supplier of new monetary signals increasing the risks of official bonds, which have led to the risks of recent bonds, which stem to protect the yuan and protect the rally in Chinese shares. Taking into account the recent Dollar Return, Beijing can afford to reduce the cost of loan to reach the target of its ambitious annual economic growth and help investors to absorb debt.

“Continuous injections of PBC will prevent the sale of debt and help restore confidence in bonds,” Analysts led by Liu Yu wrote in the entry “Huax” securities. “Support signal bond market is redefined to moderate jacket phase.”

At the beginning of this year, the China’s Money Market was under pressure, after the PBC provided Cash times to crisis, to increase the main short-term funding in June. The Central Bank also refrained from lowering the ratio of interest rates or banks from September to the reserve of banks.

At the same time, the annual supply of new government bonds in China will increase by 11.86 trillion yuan after the officials raised the overall budget deficit at about 4% of GDP at the maximum level, more than three decades.

PBOK should be more comfortable with Yuan, thus it is necessary to keep liquidity after the last decline in depreciation pressure, “said Becki Lu, China Macro Strategy.

– Hydisi from Qizi Sun.

(Updates with more comments and details)

Many Read From Bloomberg BusinessWeek

© 2025 Bloomberg LP