China to Inject at Least $55 Billion of Fresh Capital Into Several Big Banks

(Bloomberg) – China plans to start reconstructing three of its largest banks in the coming months.

Many of Bloomberg read

Authorities want to inject freshly capital at least 400 billion yuan ($ 55 billion) in the first batch of China LLC agricultural bank, Compain Co. The plan that could end in late June is subject to change, and the money for each bank is still over, the people said.

The Chinese bank regulator first stamped his plan to fill his six best state lenders in September without detailing. The Ministry of Finance later said that special sovereign bonds will promote the injections, which will strengthen the risks of banks and lend to lending.

In general, China could inject 1 trillion yuua of capital for its largest banks, mainly funding, mainly a new special sovereign debt, reports Bloomberg News.

The Ministry of Finance, the National Financial Regulatory Administration, the Agricultural Bank, the Communications Bank and the Postal Savings Bank shall not immediately respond to Bloomberg requests.

The agricultural bank climbed 2.6%, and the communication bank was 2.2% in Hong Kong.

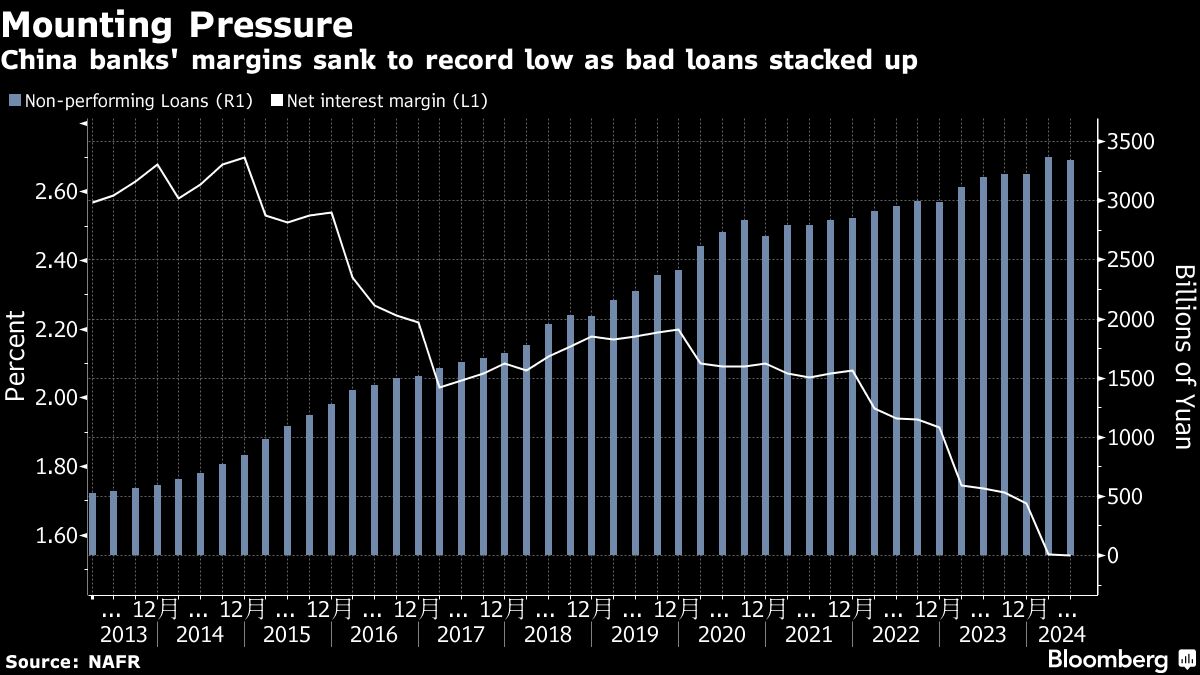

China remains the strength of its banking system, although the first six have capital levels, which are much higher, the wide decrease in the stimulus policy and the limitations of basic policy limitations. Over the past few years, lenders to support the economy now struggle with low margins, sinking profits and poor debt.

Chinese banks typically rely on saved profit to increase capital buffers, and some went to debt to use cheaper rates in the bond market. The capital injection from Beijing would mean the first such step of the global financial crisis in 2008.