Buffett touts Berkshire’s record tax payments, urges government to spend wisely

BMO Capital Markets Chief Investment Strategy Brian Belski discusses whether the market’s weight is something that should be imported to earn money.

President and CEO of Berkshire Hatava Warren Buffett Saturday released his annual letter, which gave the company’s record tax payments last year and urged the federal government to spend the money wisely.

Buffett recalled how he first bought Berkshire Hathaway 60 years ago, his old businessman Charlie Munens warned him that what great textile business was “deported to destruction.”

“The US Treasury, from all the places, received silent warnings of the fate of Berkshire,” he wrote. “In 1965, the company did not pay the income tax period, a shyness overall dominated by the company one decadeA number of such economic behavior can be understandable for charming startups, but it is a twinkle yellow light when it happens in the American industry’s dear column. Berkshire went for the ability of ashes. “

“Prompt quickly for 60 years and imagine surprise in the treasury, when the same company that still operates Berkshire Hathaway – Paid apart Moreover in corporate income tax than US government always received from any company, even American Tech Titans ordered market values trillions“Buffett wrote.

Warren Buffet’s annual letter to Berkshire Hatavayhare shareholders. Read here

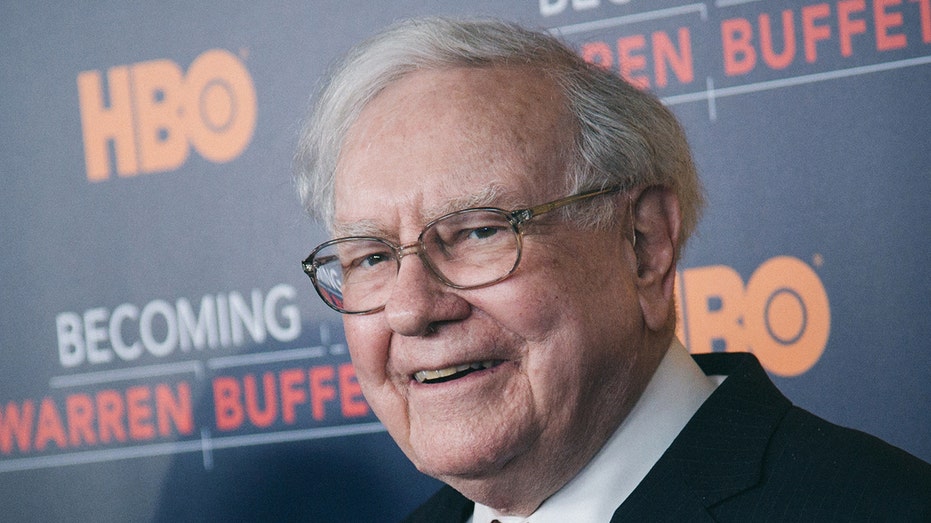

The President of Berkshir Hatava and CEO Warren Buffett gave the company’s record tax payments to his annual letter. (J. KEMPIN / GETTY Images / Getty Images)

“In order to accurately, last year Berkshire became four Payments to the IRS It was $ 26.8 billion. That’s about what it is about all paid corporate America. (In addition, we have returned income tax for foreign governments and 44 countries).

Buffett added that the company’s total income tax payments to US Treasury Over time, it has reached a total of $ 101 billion, and has been paying only one dividend for the past 60 years, which makes the basis of taxable income accumulative.

Buffett’s Surprise November letter requires a personal shade

Value investor known to keep shares in the long run also gave its high investment.

“We have dozens or so big and very large and very large and very large and highly large-scale households such as Apple, American Express, Coca-Cola and Moody’s. Many of these companies receive a very high income in their purely tangible capital, “he said.

| Grieving | Safety | Last | Change | Change% |

|---|---|---|---|---|

| Aapl | Apple Inc. | 245.55 | -0.28 |

-0.11% |

| Proof | American Express Co. | 295.37 | -8.40 |

-2.77% |

| That | Coca-Cola Co. | 71.39 | +1.34 |

+ 1.91% |

| Wanderer | Moody’s Corp. | 500.03 | -11.54 |

-2.26% |

Buffett continued to discuss The value of capitalismWhich he said that he had mistakes and abuses that “in some ways now they are more cheap than” but “can work with other economic systems with unattractive wonders.”

“True, in our childhood, our country was sometimes borrowed abroad to complete our own savings. But at the same time, we need to consistently deploy those savers that it produced, the earth would turn the wheels. “

Buffett discusses regulatory cargo

“The American process has no It’s always beautiful. Our country forever had many scoundrels and promoters who strive to use those who mistakenly trust their savings. But even with such a mischief, which remains all the power today, and the capital of capital, which eventually flooded due to brutal competition or disruption, was saved by Americans from the dreams of any colony.

“Only four million people from the base, and despite the cruel internal war, another American against the other. America changed the world in the blink of celestial eyes, “Buffett wrote.

Buffett urged the Federal government to spend wisely and provide a stable currency. (Photo by Kevin Dietschi / Getty Images)

He explained that in A “very A small remedy “Berkshir’s shareholders took part in the American miracle Subject to dividendsA number of what is originally “small, almost meaningless” is the reinterpretation of “mushrooms”.

“Berkshire’s activities now affect all the corners of our country. And we’re not over. Companies die for many reasons, but unlike one’s destiny, it is old age than in 1965, he wrote.

HotspentHoweverAs always, Charlie, I have always recognized, Berkshire would not have reached anywhere in his results, except America, while America would be successful.

Get Fox Business Go by clicking here

“So thank you, Uncle Sam. One day your nieces and nephews in Berkshire hope to send you even more payments than we did in 2024. In life. They deserve better. And never forget that we need a stable currency and that result requirement “Both wisdom and vigilance on you,” Buffett wrote.