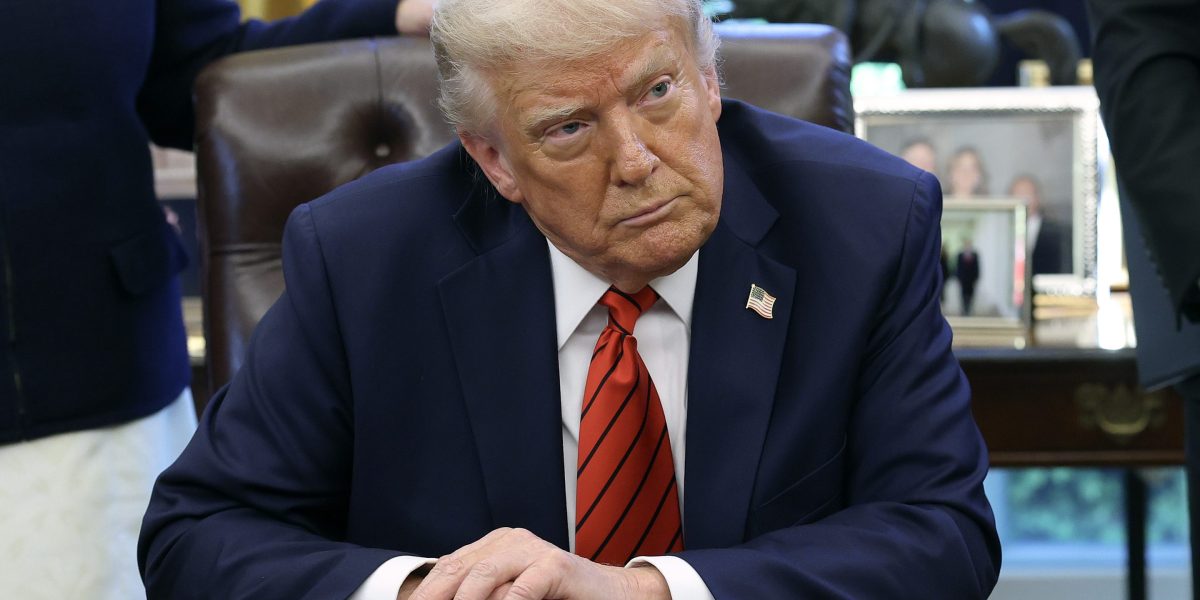

Bitcoin rebounds as the US dollar weakens and Trump feuds with Fed Chair Jerome Powell

Bitcoin and the rest of Crypto increased this earlier this week, as President Trump, which deals with Eterns and Dogkok, received both 3% in the last 24 hours.

“Bitcoin’s $ 87,000 in the US Demand is a clear signal that investors are looking for refuge in decentralized assets, tariffs, and inflation, and in global economic uncertainty, said the executive director of Goverto companies Nikolas Roberts-Hunlin. FortuneA number

Crypto market interests come because of Trump Fire threats The Federal Reserve is Jerome Powell to not leave interest as fast as possible. FEUD has caused concern over the traditional Fed status as an independent central bank, antlerable political pressure. That’s it unbeliable The President will have the power to do this, but that could have changed In the future. White House confirmed the White House on Fridaylearn“Whether the president has the power to stop stopping prior to his term until 2026.

And while the cryptic market enjoys the help rally, the traditional stock market continued to slide. While the S & P 500 and Defame Jones has left light earnings from the earlier Lows this month, both decreases by 3% on Monday.

And Trump’s public interpretations about beach seemed to have the value of the US dollar more toothed. Currency has already fallen significantly since the inauguration of Trump and on Monday, it fall From 2022 to its lowest value when compared to currencies.

Concerns about the independence of tariffs, inflation and FED are increasing, some people are investing in digital currencies, as they are separated from any centralized organization.

Said that Kow Young, Chief Economist, Bitcoin Mining Company, said Fortune When Bitcoin is engaged in short-term tandem, it can be geopolitical pressure in the long run.

“In the early stages of the pregnancy, they often behave like a risk asset, such as technological resources, sharply falling into a panic,” he said. “The markets are still stabilized, and investors are reassessed, it can show the properties of safe asylum assets that to gold.

This story was originally shown Fortune.com