Aussie bears see drop to 60 cents as Trump readies China tariffs

(Bloomberg) — The Australian dollar fell the most in six years in 2024, but its slide is far from over. there is every prospect that it will fall below 60 US cents in the coming months.

Most Read from Bloomberg

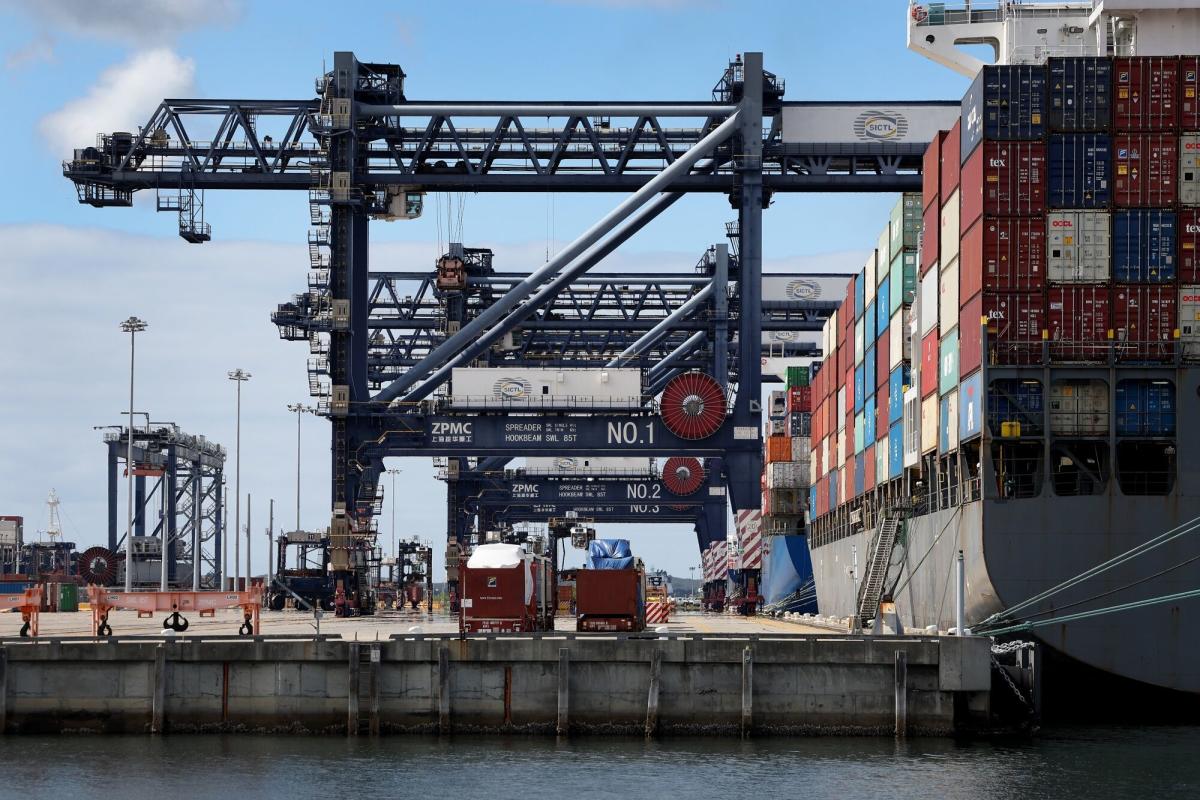

The Aussie has been hurt since late September by worsening global risk sentiment and growing expectations that the Reserve Bank of Australia will be forced to cut interest rates.Another downside is the prospect of a trade war between the US and Australia’s biggest trading partner.

“A fall of up to 60 cents is possible amid risks as US stocks fear an unfolding global trade war, China’s fiscal countermeasures are insufficient and the RBA is forced to taper quickly to provide support for,” said Gareth Berry, foreign exchange and rates strategist at Macquarie Bank Ltd. in Singapore.

The Australian dollar fell 9.2 percent last year to a low of 61.79 cents on Dec. 31 before recovering slightly to end at 62.16 cents last week.The currency’s first key support level is the October 2022 low of 61.70 cents , the break of which would put it at its weakest level since the April 2020 pandemic risk selloff. up

A test of 61.70 cents is possible as soon as this week if Australia’s November inflation data comes in below market expectations, fueling bets on an RBA rate cut at the February 18 policy meeting at the next decision.

Minutes of the central bank’s December meeting, released on Christmas Eve, included language that could be interpreted as making the February decision “straightforward,” according to Richard Franulovich, head of foreign exchange strategy at Westpac Banking Corp. in Sydney.

The minutes presented the potential to “loosen the degree of monetary policy tightening” and added in a separate section that more information on the labor market, inflation and spending would be available before the February meeting, he said.

Aussie could extend losses, even after last quarter’s 10% drop, and is likely to end March at around 61 cents, Franulovich said.

The currency fell “through thin end-of-year markets with a fragile foothold on the 0.62 handle” and a failure to break above the 0.6275 level “focuses on continued downside,” he said.