Asset managers race to set up European defence funds

Open the Editor’s Marking Free

Rulla Khalaf, the FT editor, chooses its preferred stories in this week’s news.

The asset heads are in a hurry to establish exchange of exchange on the European Defense sector, as recently has recently been a rally to reconsider their position on their position on their position.

Amundi, the largest asset manager in Europe works on the European ETF summer launch, which is associated with defense companies, with the expectation of military expenditures on the continent. Vanek, USD manager of US dollar, also studies the launch of such an investment machine.

“There is a massive race to create these products,” says Morinningar Analyst Kennetti Lamont, adding that asset managers “turn”. [them] faster than I’ve ever seen. ”

At the beginning of this month, the US Wisdetree was included in what was said, the first ETF will focus only on German, Italy and the British Stock Exchange. The Foundation has since stopped more than $ 575 million since then and has already become the second largest thematic fund of platform in Europe.

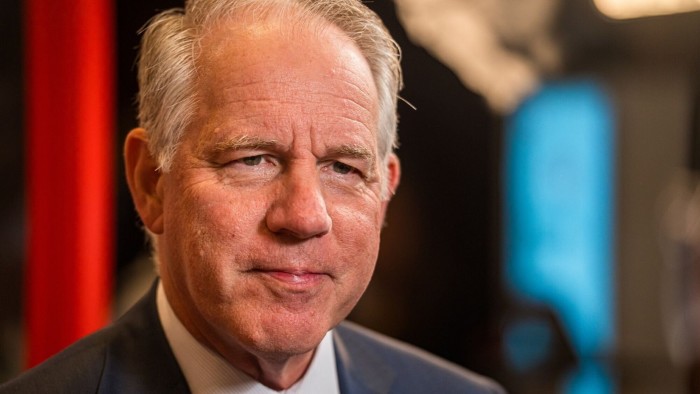

“There is a lot of interest,” says Pierre Debri, Head of European Visumtrei Research. “We have pension funds that are achieving, but also of wealth managers, retail investors.. We see customers all over.”

The sudden explosion of investors in the field of European defense takes place after the United States has provided military assistance to Ukraine in a sharp core of Russia, which is now planning to increase their weapons.

Stoxx Europe Motal Market Aerospace & Defense Index grows by 34% this year, FAR exceeds 600 in a broader STOXX Europe, as investors expect the cost boom.

Rally: He notes a refund of a sector, which is often disgraced by large investors on the continent. The funds invested in the environmental, social and management have often ruled out defense companies such as Germany’s Reinmetal and Italian Leonardo from their portfolios.

But some pension investors are discussing their defensive exceptions, claiming that the introduction of weapons producers has become important to protect democracy.

Anders Shelden, the Chief Investment Manager of the Danish Pension Fund, said that it is quite convinced that his defense policy will be discussed in the next week’s annual general meeting. “I will not rule out that the council can mitigate our position,” he said, adding that the current policy of exclusion was “quite strict.”

On behalf of the four Dutch pension funds, 616 billion managers Ronald Uugsteer, who led 616 billion euros 616 billion euros. The manager of the Great European Pension Fund currently invests about 2 billion in companies related to the sphere.

“I have never seen such a move[for European markets]A number of a number of a number can no longer view the United States as a safe, reliable partner, and we see where money has gone in recent weeks, “said Bernstein’s share analyst Alexander Peter.

The long period of underestone in Europe seems to be completed “all investors who wanted to join the party,” he added.

Tom Bailey, the Head of the Student Research based in London, which announced the ETF this week, said investors when defense defense companies became in their portfolios.

“Some people would be awkward before adding a defense company, but now it is of interest everywhere,” he said.

Historically, investors were “capricious” about the military sphere, Mike Erkekins said, the largest pension and saving British.

But now he said: