Artificial Intelligence (AI) Adoption Rates Appear Low, but This AI Leader Could See a Massive Surge in Demand in the Next 3 Years. Here’s Why.

The price of shares over the years Nvidia (NASDAQ: NVDA) It has made it one of the largest companies in the world with a market cap, which currently exceeds $ 3 trillion. NVIDIA is not alone either. Many other AI Shares: are exploded in value.

But is NVIDIA stock still going? Agreeable New research The response through Motley Fool to the adoption of AI, yes. The statistics below may be amazing for many.

You are probably well aware right now that happens right now. But what you don’t realize is that the revolution is just beginning. This will be a decades long process, creating huge purchase opportunities for early investors who remain patient. Just watch some adoption statistics made by a fool’s recent report.

The current adoption of AI for US business is only 6.8%. But in the next six months, the forecasted use of technology is 9.3%, which is 37% in just six months.

The expected growth after that, the total acceptance of AI will remain up to 10%. “These figures may seem low, given how AI is often discussed as a business modifier business,” the report said. But that’s just that point. Because today the artificial intellect is mentioned, the real adoption of it remains quite low. The rapid growth must quickly change that story, but it will last for many years, if not decades, fully out.

The fool is not alone in his finds. According to the McKinsey research of the World Counseling, the AI market will be great in 2040 than today. The numbers are not even close.

The company’s low level assessment has ai software and services from 2022 to 2022 to $ 1.5 trillion. At the highest end, it can eventually reach $ 4.6 trillion.

Looking at a single AI, McKinsey expects $ 4.4 trillion dollars to $ 4.4 trillion, as a result of economic growth, which comes from the adoption of technology.

This will be an increase in growth, such as a few others in history. But does it make a stock like NVIDIA right now? Answer can be amazing.

Growth growth market is different than investing. This is that the shares with great potential are price accordingly. Thus, while the growth rate may be impressive, the assessment you pay for it can compensate for most of those growth.

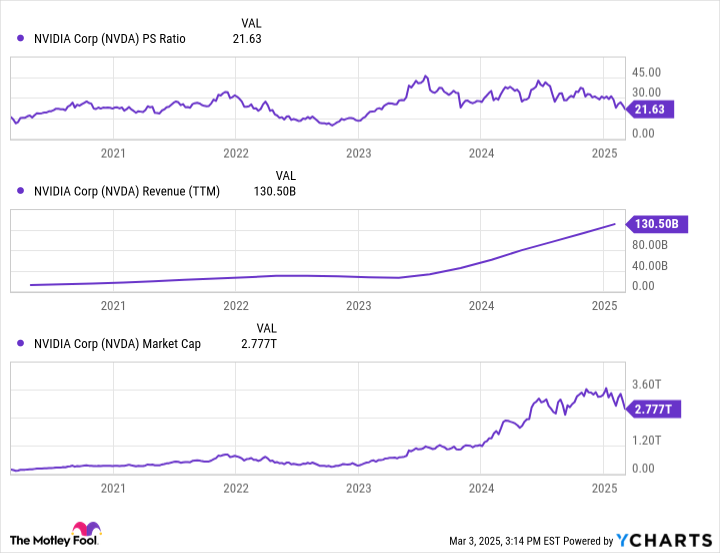

Niiddia is in a curious position right now. For Multitilion-Dollar, it’s amazing to see a multiple (P / s) of its price-selling, at 21.6. However, its income is on a huge trail of clear growth. And given the above statistics, it is reasonable to expect NVIDIA to continue for decades.