After President Donald Trump’s Sweeping Tariffs, This Is the Safest Stock to Buy — and There’s No Comparison

The large-scale tariffs of President Donald Trump sent shocking waves in the stock market. Is Dow Jones Industrial Medium: On April 3, almost 1,680 points fell, marking the worst day for the stock exchange from 2020. After Trump’s statement, investors seemed to be blindly affected by their potential economy.

Discoveries who can disappear that this is just the best in cash in cash. Although this may be the worst idea, there is one safe fund that investors can buy in the conditions of uncertainty and does not compare anything else.

Trump tariffs are so wide and so hard that almost every field will most likely have some effect, mainly because tariffs can hit us with gross domestic product (GDP). Carl Wainberg, the main economist of high frequency economics, said that in the research note, US GDP can agree 10% in the current quarter. Weinberg projects that tariffs can bite 741 billion dollars from real income or corporate earnings. Economists Jpmorgan chase Tell the tariffs make up the largest tax growth of consumer since 1968.

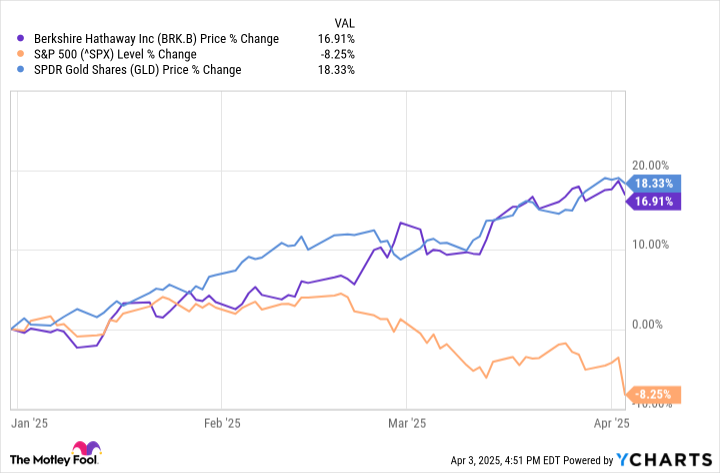

So where can you put money when it seems that the consumer can fight, and no field will be intact? Simple, give your money to Warren Buffett, investing in his company Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B)A number of Berkshire is one of the largest conglomerate in the world, and it pursues that a larger investor in the world, Buffett, who also trained a very capable of investing cereals. Berkshire has become a safe shelter for the market this year.

Berkshire not only crushed the wider market, but even gone to hang out (as presented SPDR GOLD shares ETF: (Nysemkt: GLD)), which is seen as a safer investment vehicle during uncertainty and has been in an unprecedented run. There are many reasons for investing in the Hathaway of Berkshire. For one, the company is incredibly safe and has built an epic monetary position of more than $ 330 billion, cash, cash equivalents and short-term US treasury bills.

Berkshire also runs several different businesses in many different fields. In 2024, about 48% of its income came from insurance premiums or income in which Berkshire borrowed from bonuses and invested in cash, shares and other financial instruments. Berkshire is known for its 274 billion dollars’ portfolio, which has large shares AppleTo be in style Bank of AmericaTo be in style Coca-Colaand much more. Berkshire also has Burlington Santa Fe railroad, other controlled streams of its energy assets and production, maintenance and retail sector.