The bank transfer warning of the bank you receive can be scam

We received an email from Jane writing about the suspect’s text message recently.

His experience serves as an important reminder for us to stay in front of them developing digital threats.

Let us explore Jane’s match and what we mean for our financial security in 2025.

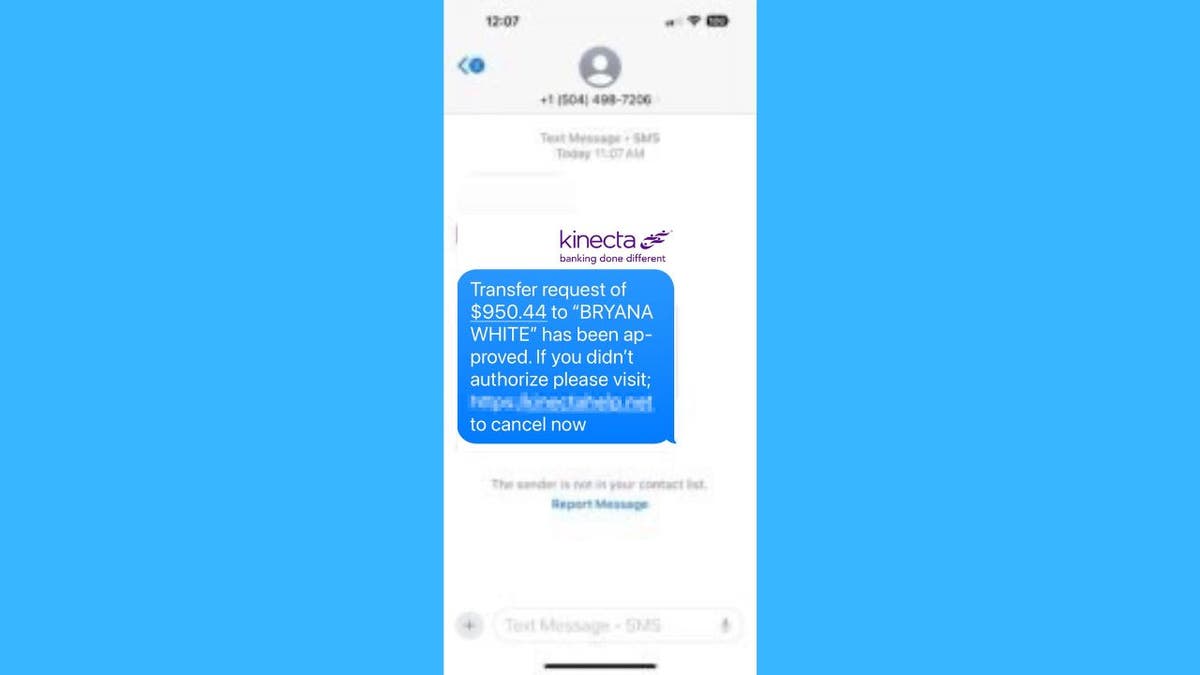

Transfer Alert A person who receives a scamming text (Kurt “cyberguy” Knutsson)

Jane’s exciting text: Try a textbook cheater

Jane wrote to us with the following concern:

“I just got a text from kinect here in California This is $ 950.44, the demand for transfer to Bryana’s network. If you have not allowed, please contact (link) now. ‘Is this a cunning text? I’m worried? “

Excellent question, Jane! Your attention is commendable and yes, you should be worried. Let’s see why this cheat try and why so much red flags raise.

Kinecta Herkar text (Kurt “cyberguy” Knutsson)

The best antivirus for Mac, PC, iPhones and Androids – Cyberguy elections

Red Flags: Spotting fraud

Jane’s Text Message Demonstrates a few telltale signs of a cheater to be aware of everyone:

As a successful weapon: Scammers use a fear of financial loss to make hurried actions. In this case, in this case, “move now” or “now” or “now cancel” or “now cancel” and immediately warn you about terrible results. This relevance is designed to pass a rational thinking and check the legality of the survey.

Suspicious links: Legal banks Avoid sending security-sensitive ties through text. These links can be downloaded to your device to download viruses to your device or have a fake website designed to steal your personal information. Always check the URL before entering any sensitive information.

Details that are not yet known yet: The record of the exact amount of “Burn White” and $ 950.44 is a smart tactic. Scammers often use special details to create the illusion of legality even if these details are unfamiliar to the buyer. This approach aims to instill doubts and relevance by increasing the chance of a victim to act in a hurry.

What is Artificial Intelligence (AI)?

Brand loss: Using scammers, similar logos, fonts and color schemes, apply brand imitation tactics. This deceptive strategy is designed to believe that you have interacted with a reliable institution, thus increasing the likelihood of falling for their scams.

Unexpired Contact: Be careful of unexpected texts claiming that you are from your bank, especially if you have not registered for text signals.

Spelling and grammar errors: Look for error in spelling, grammar or punctuation. Legal messages from banks are usually written by experts and are free from mistakes.

Surveys for personal information: Scams often ask you to “confirm” information like your account number or password. Legal banks do not require sensitive information through text.

It is very good to be a real offer: To treat the messages that promise to great income or unexpected winds.

Pressure tactics: Scams often use threatening language or use intense deadlines to threaten you to move quickly without thinking.

A person who receives a cheater (Kurt “cyberguy” Knutsson)

How to fight against debit card hackers after your money

Scammer’s Game Book: Objectives Opened

There are 3 clear goals in these digital scams:

- Information Theft: To fake fake sites to dial the login credentials.

- Distribution of malicious software: To seduce you to download malware.

- Financial fraud: Manipulates sensitive financial information.

Here is a cheat description (Kurt “cyberguy” Knutsson)

9 Road cheaters can use your phone number to try to deceive you

How to protect yourself from text scammers

As scammers are increasingly advanced, it is very important to arouse knowledge with knowledge and take active steps to protect your personal information. Seven important advice to help you remain protected here:

1. Never tap suspicious links in text messages: In Jane’s work, by clicking on the link, could have caused the fake Kinecta website designed to steal login credentials.

2. There is a strong antivirus program: This can help you discover and block the harmful program that can be downloaded if Jane clicks on the cheat link. The best way to protect yourself from harmful links to the harmful links that potentially obtain your personal information is to have the installation of an antivirus program on all your devices. This can also warn phishing emails and ransomware scammers, protecting your protection, personal information and digital assets. Get my options for the best 2025 Antivirus Protection Winners for Windows, Mac, Android and iOS devices.

Get the fox work on the way by clicking here

3. Contact your bank directly using the official channels: Jane should check Kinecta’s official number to check if you have a real problem with a real problem than to answer the text.

4. Report your text to your bank and send it to 7726 (SPAM): Notinging this text, Jane Kinecta and his mobile operator can help protect other customers from similar cheats.

5. Activate two factor authentication (2fa) In your accounts: This additional security layer may prevent preventing from entering Jane’s account, even if they receive their password.

6. Use SMS filter tools provided by your mobile carrier: These tools caught the “Kinect” text of the Suspect without reaching the Inbox of Jane.

7. Invest in personal data removal services: This can help reduce the amount of personal information available online, and the scammers are difficult to target you with individual attacks in the future. If no service promises to promise to promise to promise to delete all your data from the Internet, you can constantly watch and automate your data from hundreds of sites in a period of time, an elimination service is excellent. See my best options for data removal services here.

Kurtun Key Ways

Remember, please click legal financial institutions immediately to move immediately or links to text messages. In case of doubt, always contact your bank directly using the official channels. Jane, Jane, to bring this to our attention. Your virgin only protects you and helps you educate others. We can stay ahead of the cheats together and protect our finances.

Click here to get FOX News app

Do you think regulators, such as governments, FCC or mobile providers, discontinue the rise of fraudulent texts and protect consumers from these harmful schemes? Let us know by typing us Cyberguy.com/contact

For more technological recommendations and security signals, subscribe to the free cyberguy report newsletter Cyberguy.com/newsletter

Ask us a question or let us know the stories you want to surround us

Follow Kurt in their social channels

Most Asked Kiberguy Questions Answers:

New from Kurt:

Copyright 2025 cyberguy.com. All rights reserved.