2 No-Brainer Warren Buffett Stocks to Buy Right Now

If you have a pile of burning a hole in your pocket, consider it to work in the stock market. Long-term investment is a great way to build wealth, and few know it better than investing once a modest Holding company. Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B)1.1 trillion worth of behehemoth.

Below I will discuss why Chinese electric car (EV) manufacturer Bead (OTC: Yes) – As well as the shares in Hatavay, Berkshire, could now make great shopping.

Where to invest $ 1,000 now? Our analyst team just revealed what they believe 10 Best Shares: Buy right now. Continue “

Since 2003, BDD has been riding China’s industrial miracle in China since 2003. It starts as a company of battery production and electronics, before posting electric vehicles after a few years. Warren Buffett began buying shares in 2008 and now belongs to a significant $ 2.5 billion worth of Buddy’s shares, which represents about 1% of the total portfolio of Berkshire.

It’s easy to see why he loves company. Buffett seeks deep businesses Economic cavitiesthat refers to a competitive advantage they have towards industry competitors. In the case of the BDD, MOT is the company’s vertical integration, as it contains its batteries on a scale, enabling the cost savings to consumers.

However, BYD is not just about low prices. The company has started to appear as a technology leader.

In March, it opened a new technology, which is capable of charging EVS in just five minutes, providing up to 249 miles away. If it makes it in mass production, it can significantly close the convenience of the convenience between electric cars and their gasoline-nourished partners.

BYD estimate is also very good to ignore. With Transfer Price-earnings ratio (Page / e) Only 19.5, shares are significantly cheaper than the opponent VisitationWhich trade in front of 84 P / E? The profit of the fourth quarter increased by 73% by 73% year by year.

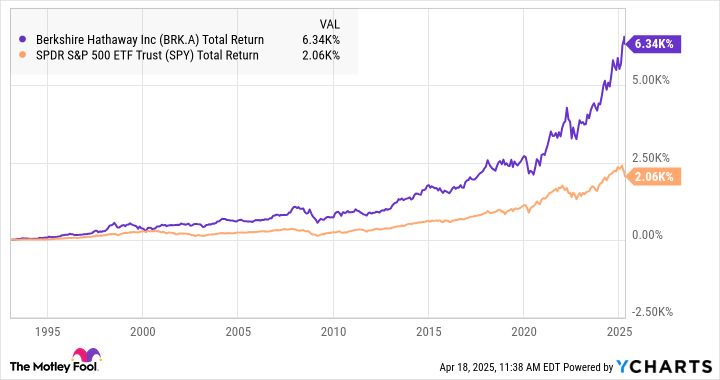

Instead of buying individual shares, some investors may want to bet on the entire Berkshire portfolio. This step will allow more diversification in different industries, while operating the complete strategy of Warren Buffett and the instinct of market beatings.

Buffett became famous. Multibilion-dollar positions in leading US companies AppleTo be in style Coca-Colaand American Express:Omaha Oracle puts his money in his mouth. And in terms of performance Berkshire Hatavay has been consistently beaten S & P 500A number